Enterprise Risk Management

Quickly assess and take action on your organization’s biggest risks with a connected view of risks and controls.

Your company might meet the limited regulations of today, but are you ready move quicky when regulations ramp up? Risk Cloud gives companies of all sizes the enterprise-level power to manage risk and adapt to changing regulations, so you’re ready for whatever comes your way.

See For Yourself

FinTech is a huge target for cybercriminals. And consumers and lawmakers are pretty demanding when it comes to privacy — rightfully so. Identify security gaps, solidify your defenses, and set up response protocols with Risk Cloud.

See the Difference with Risk CloudWhen the auditors come knocking, you’ll be ready. As a holistic GRC platform, Risk Cloud has robust audit reporting, documentation, and sign-off features that ensure your internal audits will catch issues before the auditors are at your door.

View Internal Audit Solution Brochure

- Head of Risk and Compliance, Computer Software

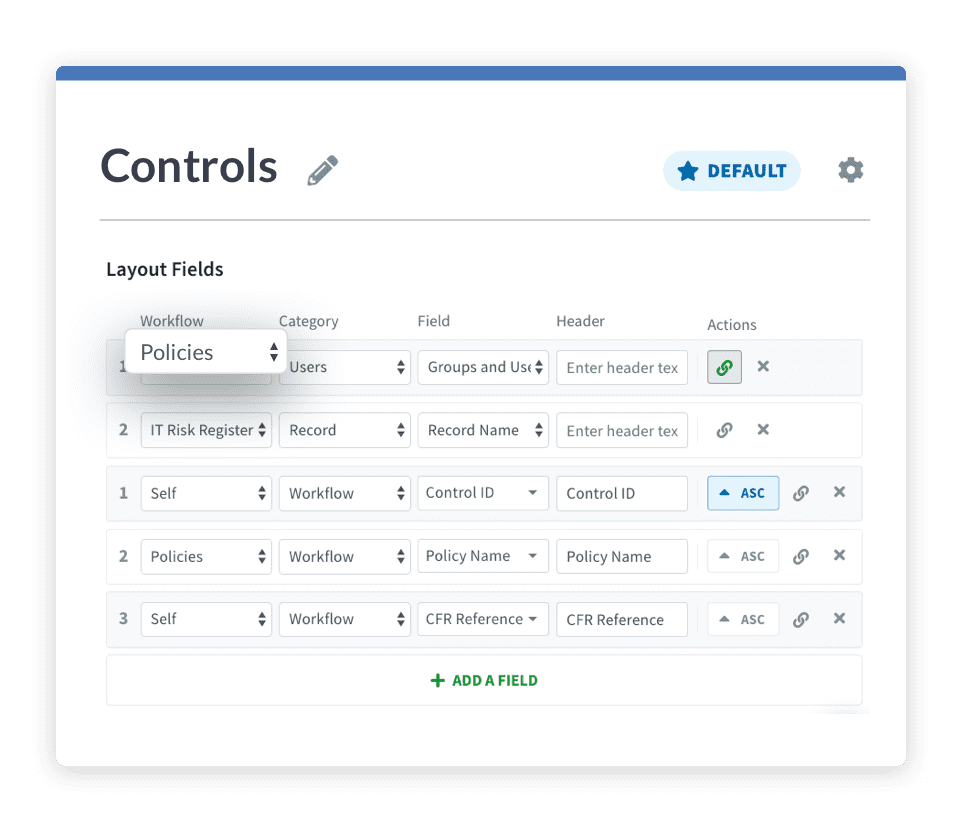

Quickly assess and take action on your organization’s biggest risks with a connected view of risks and controls.

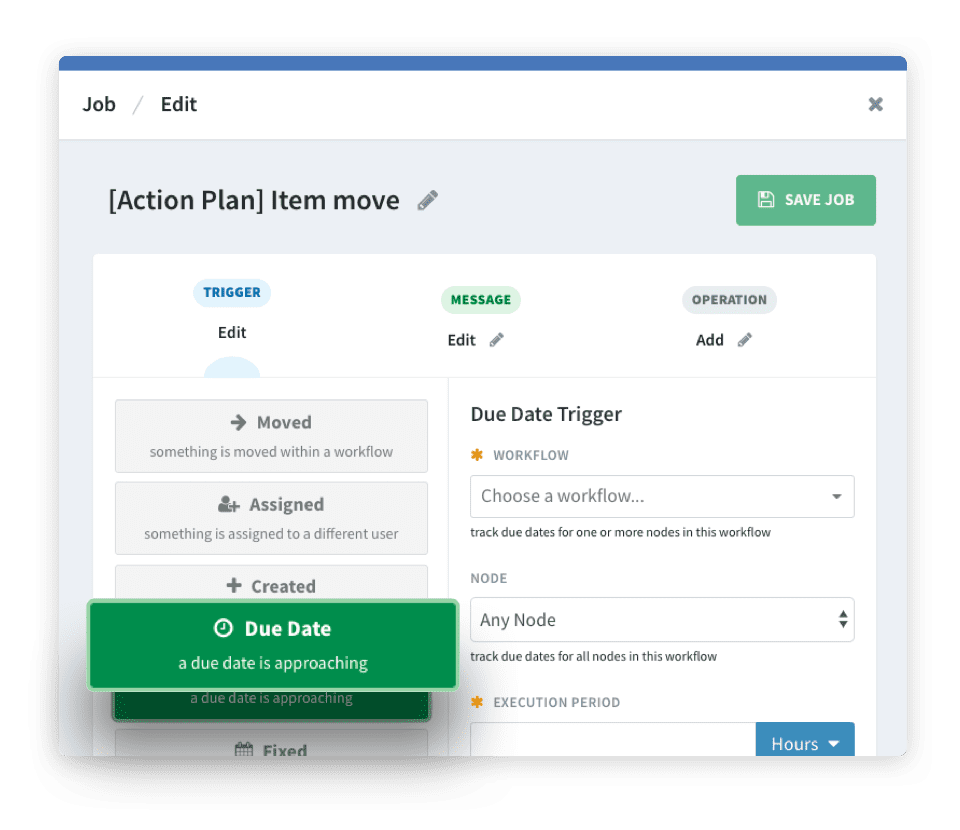

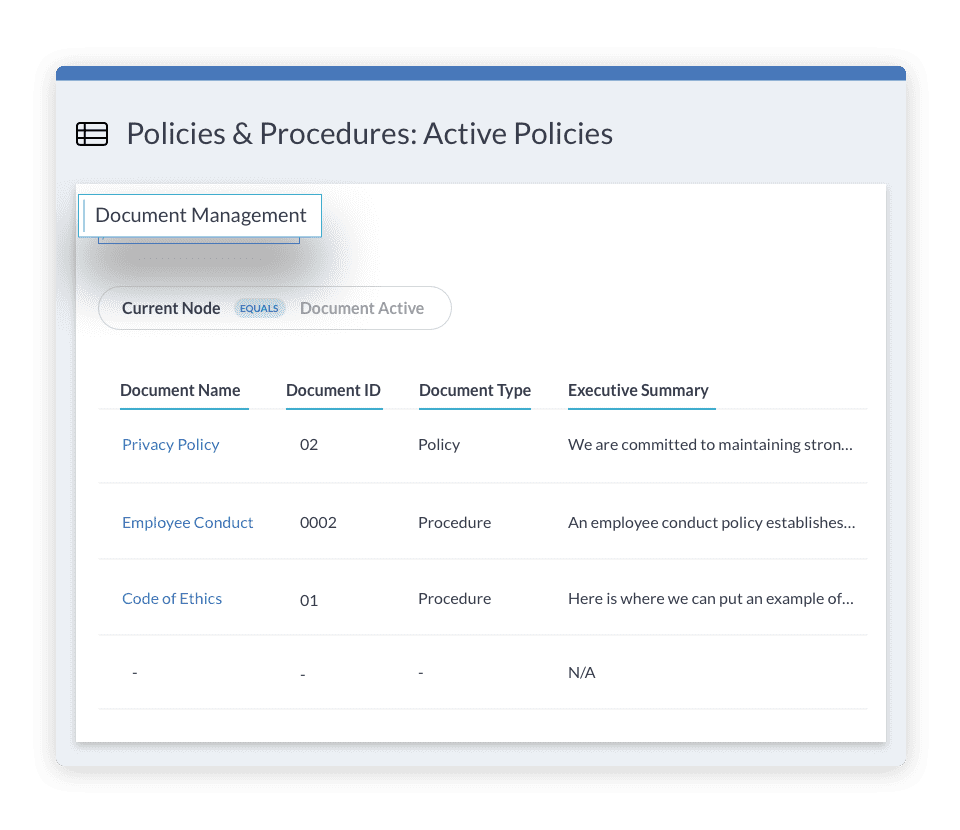

Dynamically link your overlapping regulations, obligations, and controls to identify gaps and reduce redundant tasks.

No more flipping through multiple tabs and systems. Find everything you need in one place to resolve issues.

If you want your GRC engine to run smoothly, you need to look at systems holistically. Create a…

Uphold identified LogicGate’s Risk Cloud platform as the all-encompassing platform they needed and has been able to leverage…

The EU AI Act marks a significant step towards regulating artificial intelligence, setting a global standard for AI…

AI has exploded onto the tech scene in the last year, bringing with it huge promises and potential.…

The pressure to leverage generative AI to enhance business performance is a critical priority for most companies today. …