Purpose-Built Solutions to Empower Financial Services

Risk Cloud® delivers tailored GRC solutions to financial institutions, helping reduce risks, enhance operational efficiency, and meet regulatory demands. Trust our purpose-built platform to ensure your organization stays secure and compliant in an evolving landscape.

Simplifying Compliance and Enhancing Security for Financial Institutions

Safeguard your reputation and enhance stakeholder trust with dynamic risk visibility and seamless regulatory compliance management for banks, credit unions, and financial institutions.

Designed with Financial Institutions in Mind

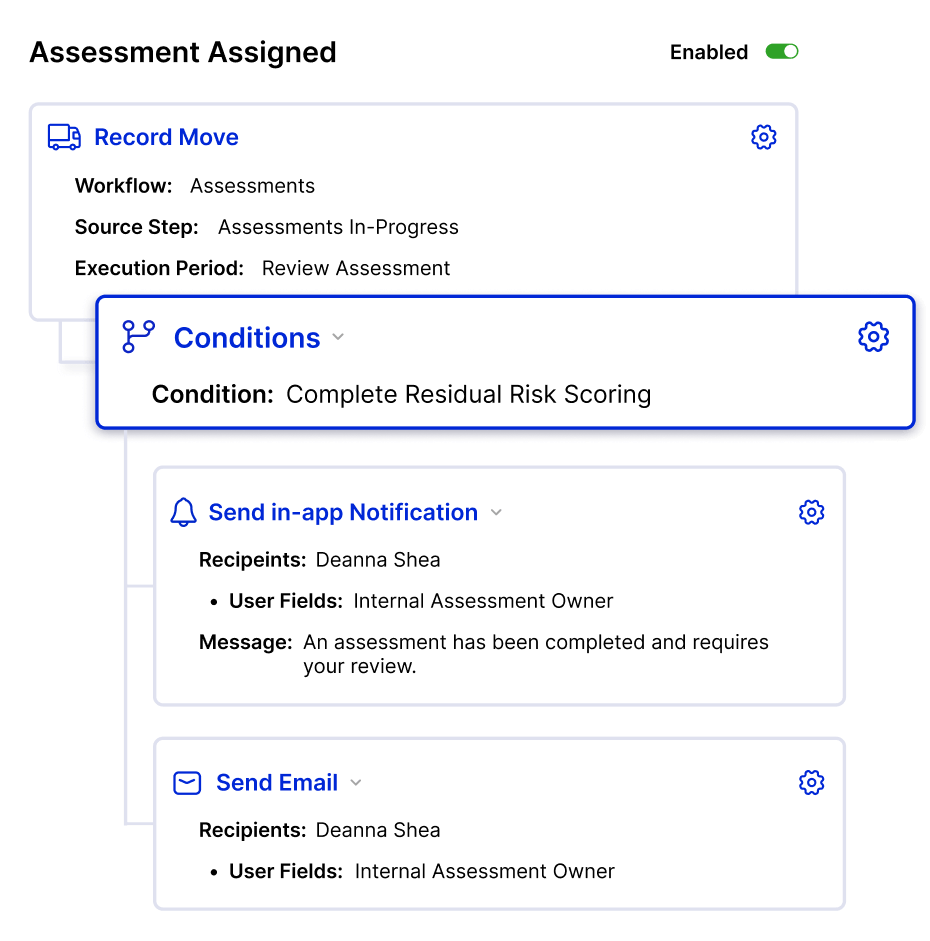

Stay ahead of regulatory changes effortlessly with an always-current obligations repository, automated alerts, and seamless workflows for proactive change management.

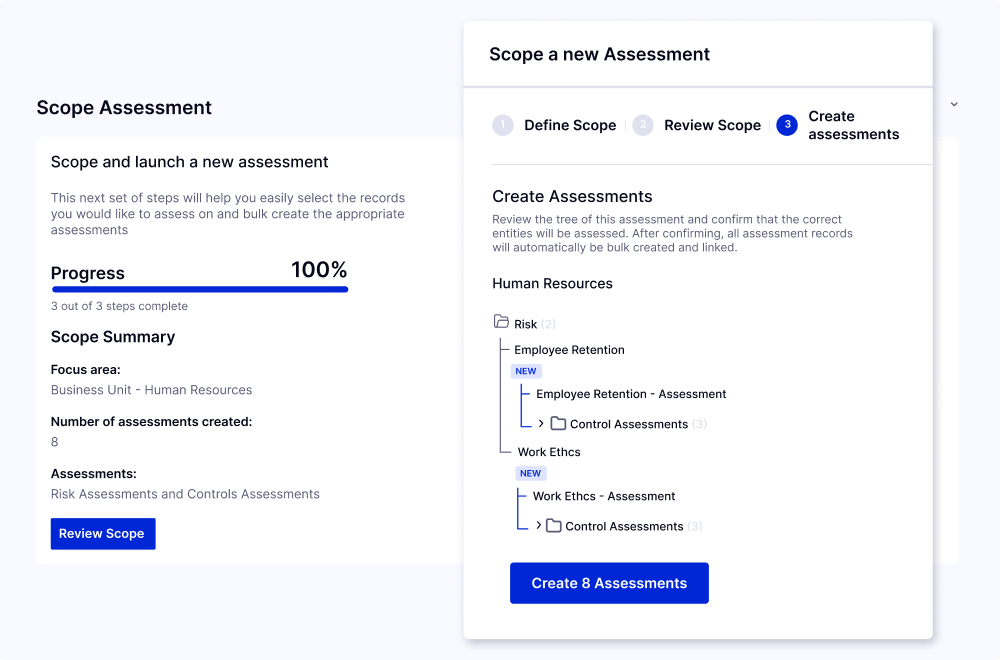

Automate risk and control self-assessments while freeing resources, reducing manual work, and quickly addressing compliance gaps.

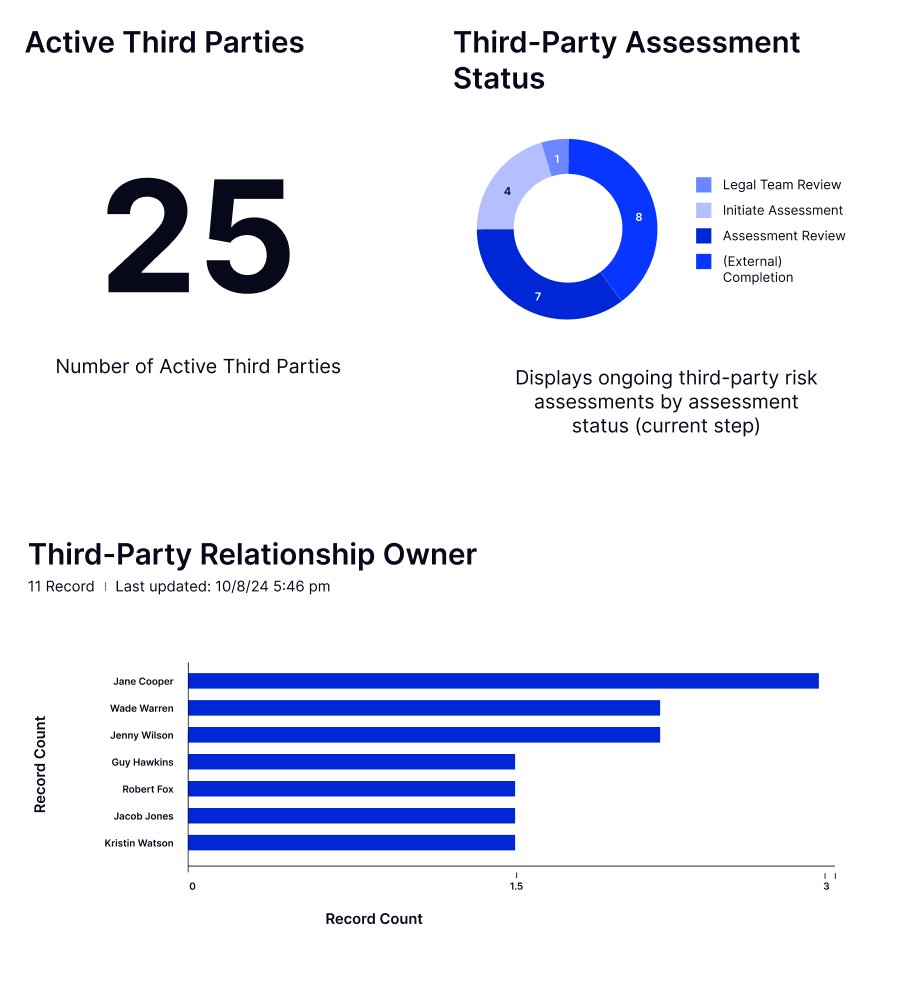

View, analyze, and act on data across GRC programs and banking functions while ensuring teams have the most relevant insights for rapid decision making.

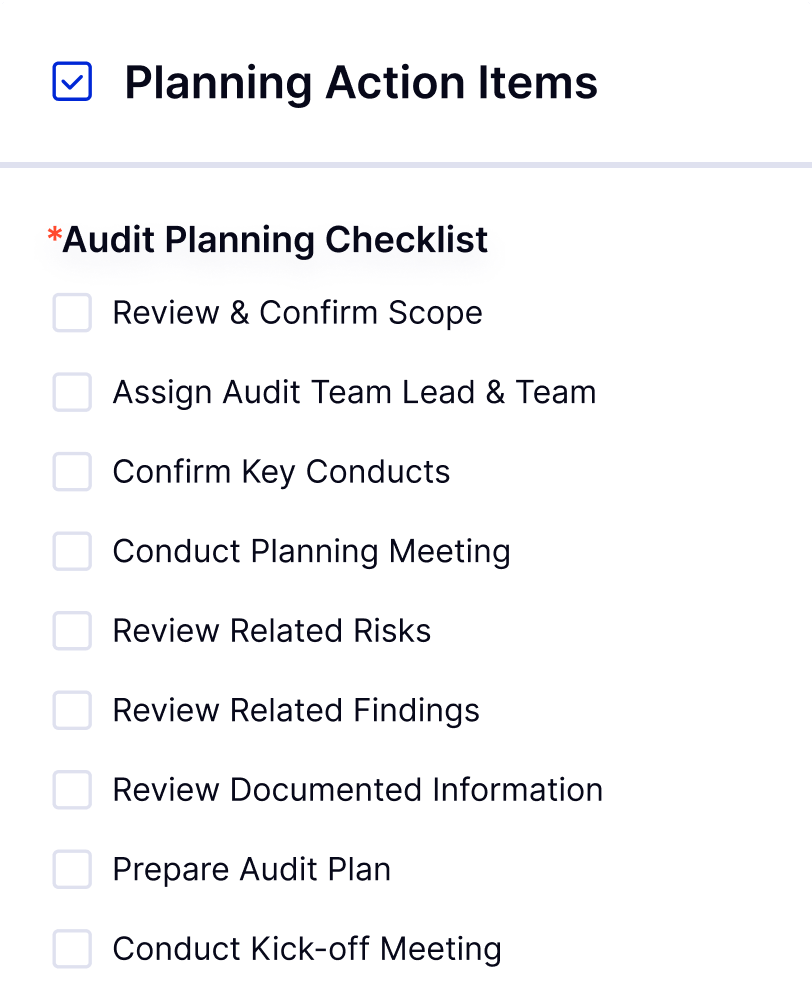

Centralize issue management and automate action plans to streamline audits and generate detailed reports for internal and external stakeholders.

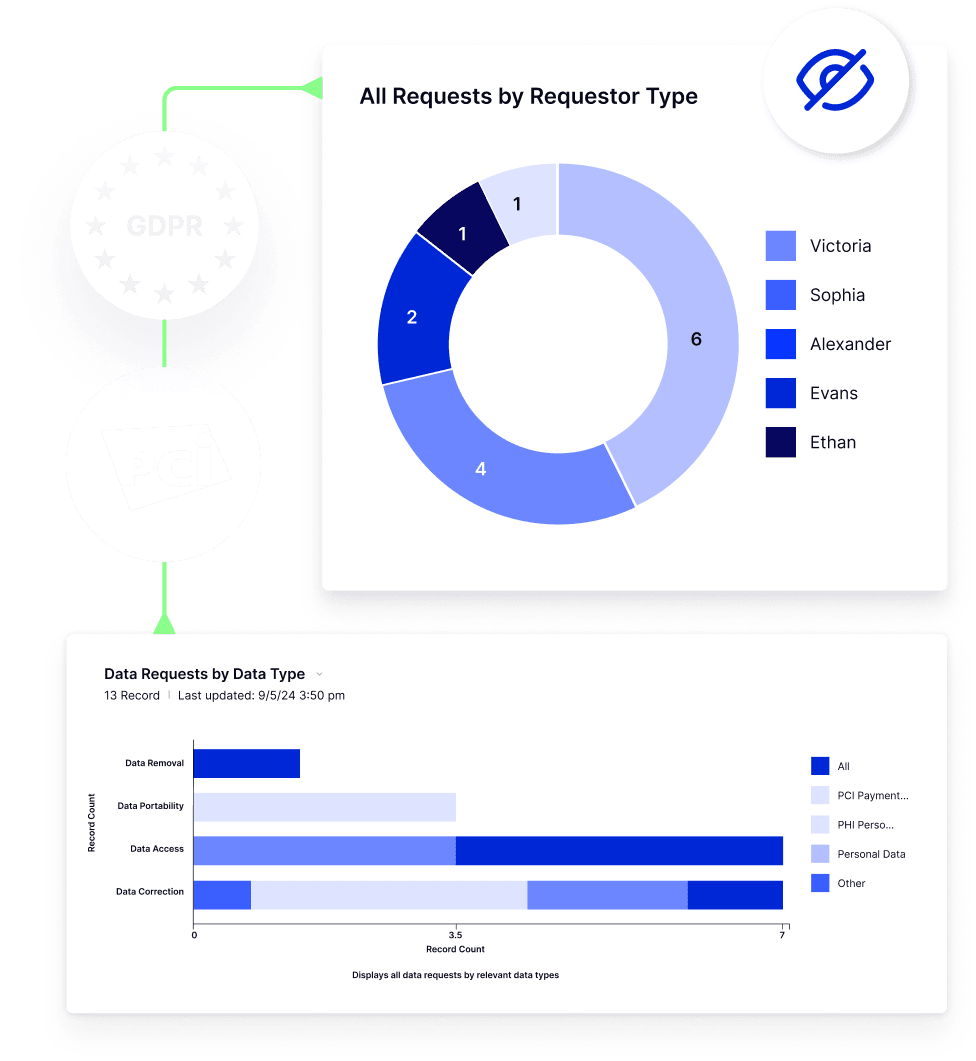

Robust tools to secure customer data and ensure privacy compliance to GDPR, PCI DSS, and others.

Mitigate risks associated with vendors, suppliers, and partners.

Why Do Financial Institutions Choose LogicGate?

Frameworks

Align with Industry Best Practices and Regulatory Requirements

Integrations

Seamless Integrations to Enhance Efficiency, Data Flow, and Effectiveness

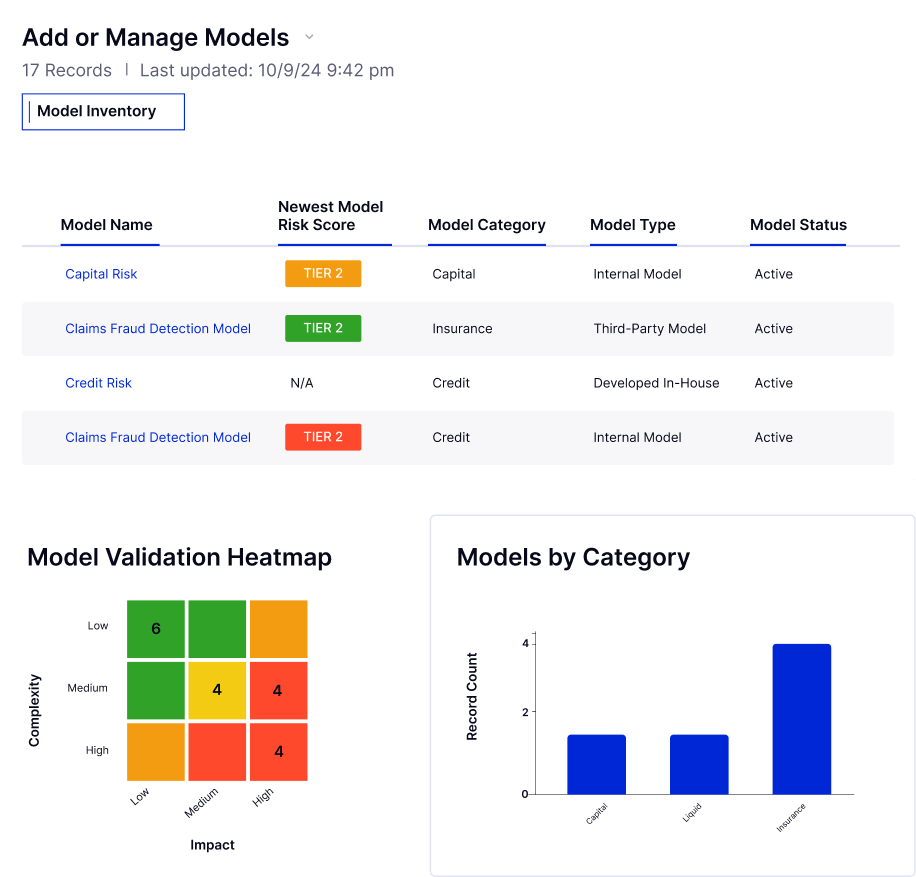

Safeguard Your Bank’s Future with RCSA

Don’t let unmanaged risks jeopardize your success. With our Risk and Control Self‑Assessments (RCSAs), you can take swift, decisive action to protect your institution from potential threats.