Internal Audit Through the Years

Picture this: It was the early 2000s. The Backstreet Boys topped the charts. The Red Sox had just broken their curse and won the World Series. But in our office, the ENRON scandal had everyone on edge.

I was working at an insurance company, and like many others in highly regulated industries, we found ourselves sifting through decades of financial records, searching for any signs of fraud, waste, or abuse, armed with nothing more than a red pencil, a few bulging binders, and a lot of caffeine.

Back then, internal audit was grueling, manual, and deeply misunderstood. We didn’t have the technology to do it efficiently or the recognition of how strategic our role could be.

Fast forward to today: internal audit has undergone a profound transformation. The profession has increasingly embraced technology, with 92% of respondents in a global survey agreeing that new technology is key to helping internal audit add more value. The teams once seen as policy-enforcers are quickly becoming proactive, technology-enabled functions that empower organizations to assess risk, align with strategy, and drive continuous improvement.

And it’s not slowing down. According to the U.S. Bureau of Labor Statistics, employment for accountants and auditors is projected to grow 6% from 2023 to 2033, faster than the average for all occupations. As we celebrate Internal Audit Month in May and look ahead to the GRC Conference this August, it’s the perfect time to explore the evolving role of internal audit: what it is, why it matters, and how modern best practices can position audit teams as key drivers of resilience and business value.

What is Internal Audit?

According to the Institute of Internal Auditors (IIA), “Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations.” Internal audit functions help organizations accomplish their objectives through a systematic, disciplined approach to risk management, control, and governance processes.

Who needs an Internal Audit function?

In the U.S., the Sarbanes-Oxley Act (SOX) of 2002 made internal controls and audit functions a legal requirement for public companies to ensure accurate financial reporting and fraud prevention. Additionally, the need for an internal audit function has traditionally been driven by size, complexity, and regulatory exposure. For example, banks, investment firms, and insurance companies operating in the U.S. are required by regulators like the Federal Reserve and the Office of the Comptroller of the Currency (OCC) to have robust internal audit programs due to their exposure to financial and personal information. Similarly, healthcare providers in the U.S. need internal audits to monitor risk to private health information and compliance with HIPAA regulations.

However, as business risks and technologies have evolved, the case for internal audit has expanded beyond just those traditional boundaries. Smaller, fast-growing, or private companies now increasingly adopt internal audit to stay ahead of risks and support sustainable growth. Larger organizations with higher stakes in public trust or financial accuracy are also using a formal mechanism to keep leadership accountable, detect risk early, and ensure governance. These organizations know that without a robust internal audit function, they risk non-compliance, financial misstatements, and operational inefficiencies, which can lead to reputational damage and financial loss. Just ask JP Morgan Chase, which, in 2020, faced a $250 million civil money penalty after the OCC found the bank failed to maintain adequate internal controls and internal audit over its fiduciary business.

It has become abundantly clear: a well-established internal audit function is a core component of effective corporate governance and risk management. Whether a company is public or private, global or regional, having an independent, empowered internal audit function is no longer optional; it’s foundational to sustainable growth and resilience.

Where does Internal Audit fit in?

Internal audit is often known as the “third line of defense” after operational management and risk and compliance teams. The internal audit team’s job is to provide independent assurance to stakeholders and the board that the first and second lines’ efforts are consistent with organizational expectations. By operating independently from management, internal audit offers objective evaluations and contributes to the organization’s overall governance framework.

Unlike external auditors, who assess an organization’s financial statements annually for regulatory compliance, internal auditors evaluate all areas of the business throughout the year. Their focus is on internal controls, operational efficiency, and risk mitigation.

Internal audit also plays a critical role in maintaining corporate governance. The function supports accountability and transparency, ensuring that organizations act in the best interests of their stakeholders. But it goes even deeper than that.

Internal audit acts as the organizational glue, bridging the gap between operational execution and strategic oversight. It ensures that risk management practices are aligned with business objectives and that policies and procedures are being followed. This function brings objectivity, structure, and trust to decision-making. By identifying potential pitfalls before they escalate and ensuring that governance mechanisms are functioning as intended, internal audit strengthens an organization’s ability to withstand disruption, adapt with agility, and thrive in a dynamic regulatory landscape.

Key Benefits of Internal Audit

A well-executed internal audit program doesn’t just protect an organization from risk; it drives smarter decisions, enhances performance, and builds stakeholder trust. While the value of internal audit has long been acknowledged in theory, modern tools and evolving expectations have pushed its role firmly into the strategic spotlight. Here are some of the key benefits organizations can realize by investing in and modernizing their internal audit function.

- Enhancing Operational Efficiency: Internal audits uncover inefficiencies and recommend process improvements. Automating workflows can reduce manual tasks and free up time for strategic activities.

- Strengthening Risk Management: Internal audit identifies emerging risks, tracks mitigation strategies, and provides real-time insights into the organization’s risk posture. Dynamic control assessments unlock visibility across the enterprise.

- Assisting in Compliance and Financial Reporting: Internal audits ensure organizations stay compliant with regulations such as SOX, HIPAA, and GDPR. Automated evidence collection and control mapping reduce the risk of errors and increase audit-readiness.

- Supporting Stakeholder Decision-Making: By delivering timely, data-driven insights, internal audit equips senior leadership and boards with the information needed to make informed, risk-aware decisions.

- Optimizing Control Processes: Internal audits assess and improve internal controls, which can streamline operations and align them with organizational objectives.

These benefits demonstrate how internal audit can serve as more than just a compliance checkpoint. When properly equipped and strategically positioned, internal audit becomes a catalyst for organizational agility, smarter decision-making, and sustainable growth.

Fundamental Components of Internal Auditing

To deliver consistent, high-impact value, internal audit teams need a framework that ensures quality and alignment with broader business needs. The 5 C’s framework is a useful guide for organizations to evaluate and elevate the quality of their internal audit functions. Each “C” represents a fundamental element that helps ensure that internal audit functions drive real value across the business.

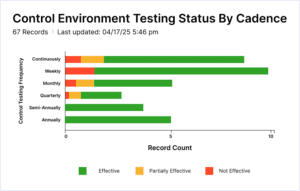

Control Environment

At its core, internal audit functions assess the effectiveness of the control environment. The control environment sets the tone for integrity, ethical behavior, and accountability within an organization. Internal audit evaluates whether the right structures, reporting lines, and controls are in place to support a culture of compliance and risk awareness.

For example, a newly appointed Internal Auditor quickly notices fragmented oversight across departments. Managers were approving their own expense reports, and procurement policies were more aspirational than enforced. The audit team conducted a baseline assessment and flagged gaps in approval processes and policy adherence. With leadership support, they rolled out updated policies, clearer reporting structures, and an ethics hotline. Within a year, the tone at the top shifted, reinforcing a culture of accountability and governance.

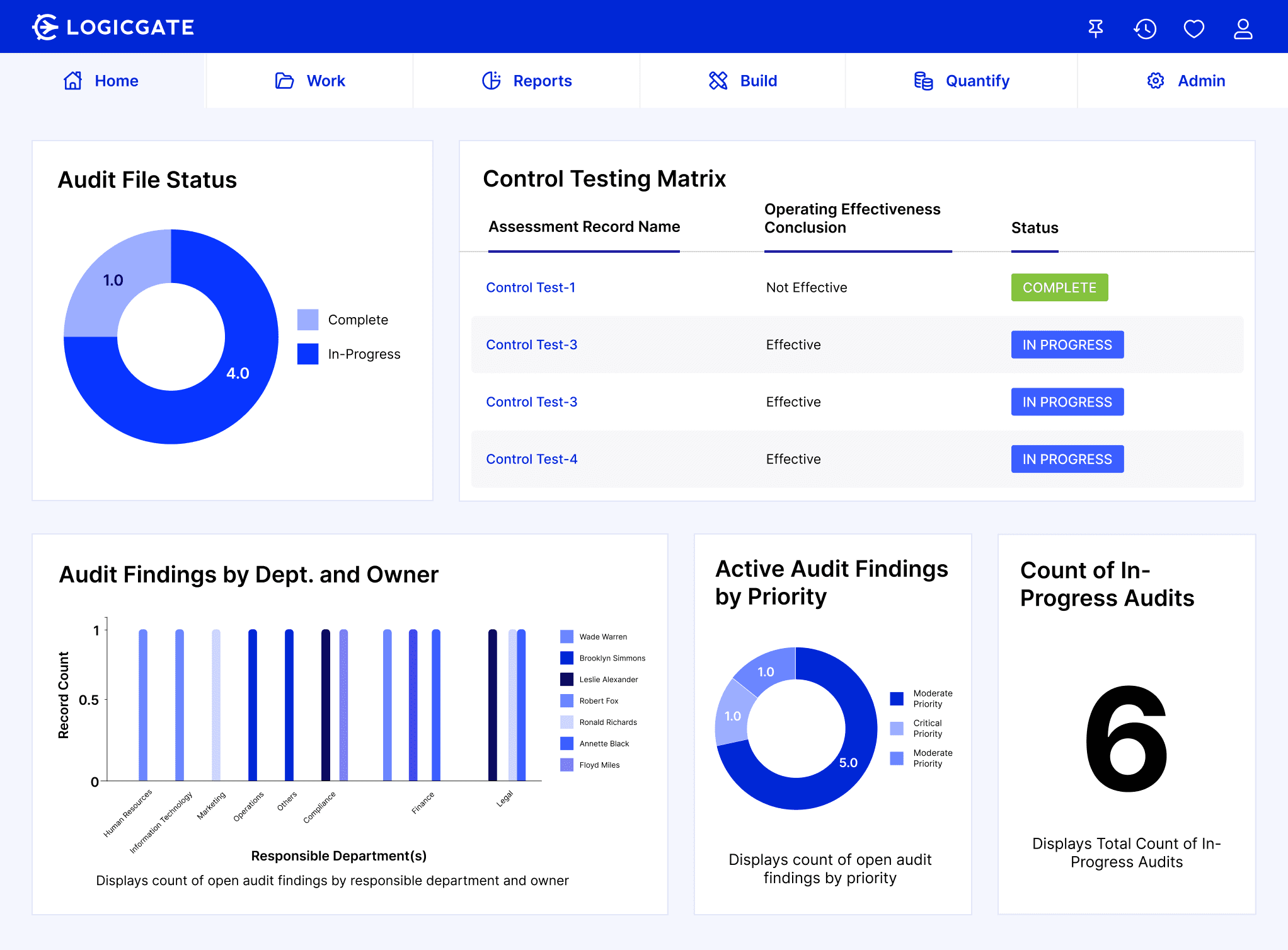

Communication

Effective communication ensures that audit findings, risks, and recommendations are clearly conveyed to key stakeholders. It also fosters transparency between audit teams and the board or audit committee. Historically, boards rarely saw audit findings until quarter-end meetings, and by then, it is often too late to take action. However, when internal audit teams use real-time dashboards, it gives executives instant visibility into critical audit metrics. This transparency opens up more proactive, two-way conversations with the board, turning audit insights into immediate business action.

The result? Greater board engagement and faster response to emerging issues.

Compliance

Internal audit also plays a crucial role in verifying the organization’s compliance with internal policies and external regulations, like SOX and GDPR. This includes proactively identifying gaps and helping the business close them. Staying current with regulatory requirements through horizon scanning enables proactive monitoring across multiple frameworks.

Regulatory monitoring also helps unlock new revenue. For example, companies looking to expand into new markets will likely take on new complex regulatory requirements. The internal audit team could lead a cross-functional effort to map new obligations to internal controls. Using automated evidence collection and conducting a gap analysis will help organizations prepare for regulatory audits with confidence.

Competence

Strong internal audit performance depends on the capabilities of the team. As audit demands evolve, teams will likely also need to upskill. Competence includes technical knowledge, certifications, familiarity with industry regulations, and the use of modern tools and methodologies. One of the most effective ways to stay current is through continuous professional education (CPE) credits, which are often required to maintain designations like the Certified Internal Auditor (CIA) or Certified Information Systems Auditor (CISA).

Conferences such as the IIA/ISACA GRC Conference offer rich opportunities to earn CPEs, network with peers, and stay informed about the latest in risk, audit, and compliance. One must-attend session this year is presented by LogicGate’s CISO, Nick Kathmann. His session, titled “Stop Throwing Money at the Problem—Take the Strategic Approach to Security and Risk,” will dive into the rising cost and complexity of cyber threats and how companies can adopt architectural segmentation to reduce both the likelihood and impact of security incidents. Attendees will walk away with real-world strategies for collaborating with architecture teams, using threat modeling to identify blast zones, and implementing network and identity segmentation to limit the impact of breaches.

If you want your audit team to not only stay relevant but lead your organization’s risk strategy, investing in competence through education and events like this is essential.

Also, consider regularly benchmarking your audit program against IIA standards and relevant regulatory frameworks. Encourage continuous education, obtain industry certifications, and monitor regulatory changes to stay proactive instead of reactive.

Consistency

Lastly, with structure and talent in place, internal audit activities need consistency. They should follow standardized, repeatable processes that ensure quality and comparability over time and across business units. Repeatable templates and automated workflows support consistency in reporting and communication, which makes it easier to compare year-over-year progress and spot system risks early.

Together, these components create a strong foundation for internal audit programs. They enable teams to maintain accountability, improve risk visibility, and support enterprise resilience through repeatable, efficient, and high-integrity processes.

Strategic Planning in Internal Audit

While the 5 C’s help audit teams build a solid foundation, the 5 P’s—Purpose, Process, People, Performance, and Progress—provide a roadmap for long-term success. These elements help teams focus efforts, align with broader business priorities, and continuously improve audit value over time.

Purpose: A successful internal audit function must align its mission with the organization’s broader strategic objectives. This means moving beyond compliance to actively supporting goals like enterprise risk reduction, operational efficiency, and organizational resilience. Define a charter that clearly communicates the internal audit department’s purpose and value as a strategic partner.

Process: Build your audit plan based on risk. Use formal risk assessments to identify areas of highest impact, then prioritize audit activities accordingly. Ensure audit programs are dynamic and adaptive by updating them frequently to reflect changes in business operations, external threats, and regulatory demands. Workflow automation tools can help standardize the process and ensure consistent execution.

People: Purpose and process are foundational, but investing in team member development will bring internal audit functions to the next level. Internal audit must have the right mix of skill sets, including financial acumen, operational knowledge, cybersecurity awareness, and communication expertise. Empower your people with collaboration tools and data analytics capabilities that enhance both productivity and insight.

Performance: Measure what matters. Go beyond completion rates and track Key Performance Indicators (KPIs) such as audit cycle time, issue remediation speed, stakeholder satisfaction, and control effectiveness. Regularly report on performance metrics in a way that is easy to digest and act upon. Use dashboards and visualizations to elevate insights and facilitate real-time decision-making.

Progress: Foster a continuous improvement mindset. Regularly review audit results, stakeholder feedback, and industry trends to refine your audit approach. Audit reporting should inform risk strategy, not just highlight gaps! Celebrate improvements and use this progress as a launchpad for innovation and enterprise-wide learning.

By incorporating the 5 P’s into their strategic framework, audit leaders can transform internal audit from a reactive function into a proactive driver of business value. The result is a high-performing team that not only protects the organization, but helps it grow stronger, smarter, and more resilient with every audit cycle.

Best Practices for a Successful Internal Audit Program

Great internal audit programs don’t just happen. They’re built through thoughtful design, the right technology, and a culture of continuous improvement. While every organization has its own risk landscape, the most effective audit teams share a common playbook.

Here are key actions any team can take to level up their program:

- Standardize Audit Workflows: Use repeatable templates and automation to drive consistency. Be sure to define ownership at every stage to streamline collaboration and accountability.

- Prioritize Cyber Audits: Focus on access controls, data governance, and third-party risk. Whenever possible, work with system owners to automate the collection of evidence. This will enable a long-lasting relationship built on mutual success.

- Streamline Reporting: Ditch static reports for dynamic dashboards tailored to your audience. And remember, what resonates with the board won’t be the same as for a department lead. So you may need to tailor content to specific audiences.

- Benchmark Against Standards: Regularly assess your program against IIA, SOX, and industry frameworks.

- Foster Cross-Team Collaboration: Build strong relationships with compliance, IT, legal, and HR to enable early identification and faster remediation of risks.

- Stay Agile: Update audit plans often to reflect business and risk changes. Use tools that allow for on-the-fly updates, dynamic scoping, and integrated issue tracking.

- Invest in People: Support training, certifications, and conference attendance to stay sharp.

When internal audit embraces modern tools and a collaborative mindset, it becomes more than a safeguard, it becomes a force multiplier. Teams can spend less time chasing paperwork and more time driving business resilience, innovation, and strategic value.

Let’s Elevate Internal Audit Together

There’s never been a better time to reimagine what internal audit can be. Join LogicGate for “On Tour with LogicGate: Internal Audit Management” – the latest in our Risk Cloud demo series. Whether you’re a seasoned audit executive or just starting your journey, modern tools and frameworks can help your team shift from reactive to strategic.

We’ll show you how Risk Cloud can help you:

- Automate manual workflows

- Increase visibility across the audit lifecycle

- Ensure audit readiness year-round

- Align with IIA standards and beyond

Request a demo today, and let’s unlock the future of audit together.