You're Not in This Alone.

Deliver high-value insights in less time with Protiviti’s proven risk quantification expertise.

Quantify and communicate risk in the language every stakeholder understands — money. Risk Cloud Quantify® enhances traditional quantification techniques with Monte Carlo simulations and supports the Open FAIR™ Model. From cyber risk to enterprise risk, we’ll help you communicate risk with clarity and confidence.

![[2022-11-11-02-44-51]___risk-cloud-quantify-financial-value](https://www.logicgate.com/wp-content/uploads/2022/11/2022-11-11-02-44-51___risk-cloud-quantify-financial-value.png)

Deliver high-value insights in less time with Protiviti’s proven risk quantification expertise.

Risk Cloud Quantify adds financial context to risk decisions to improve collaboration and understanding across business units. It integrates with every Risk Cloud Application, so you can scale your risk quantification strategy from one centralized platform as your team and organization grows. With Risk Cloud Quantify, you can:

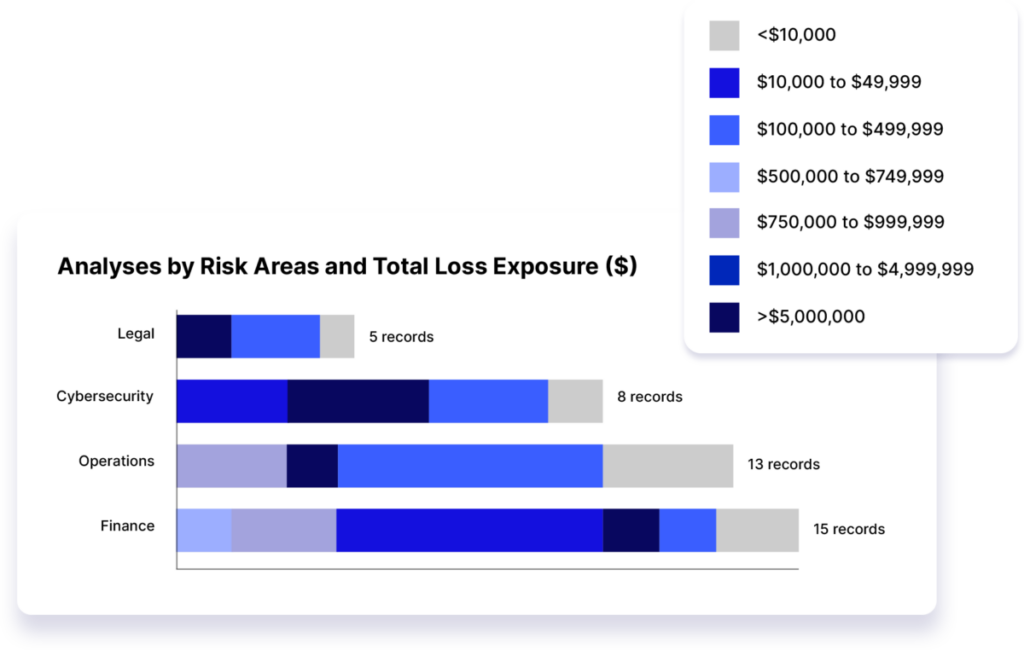

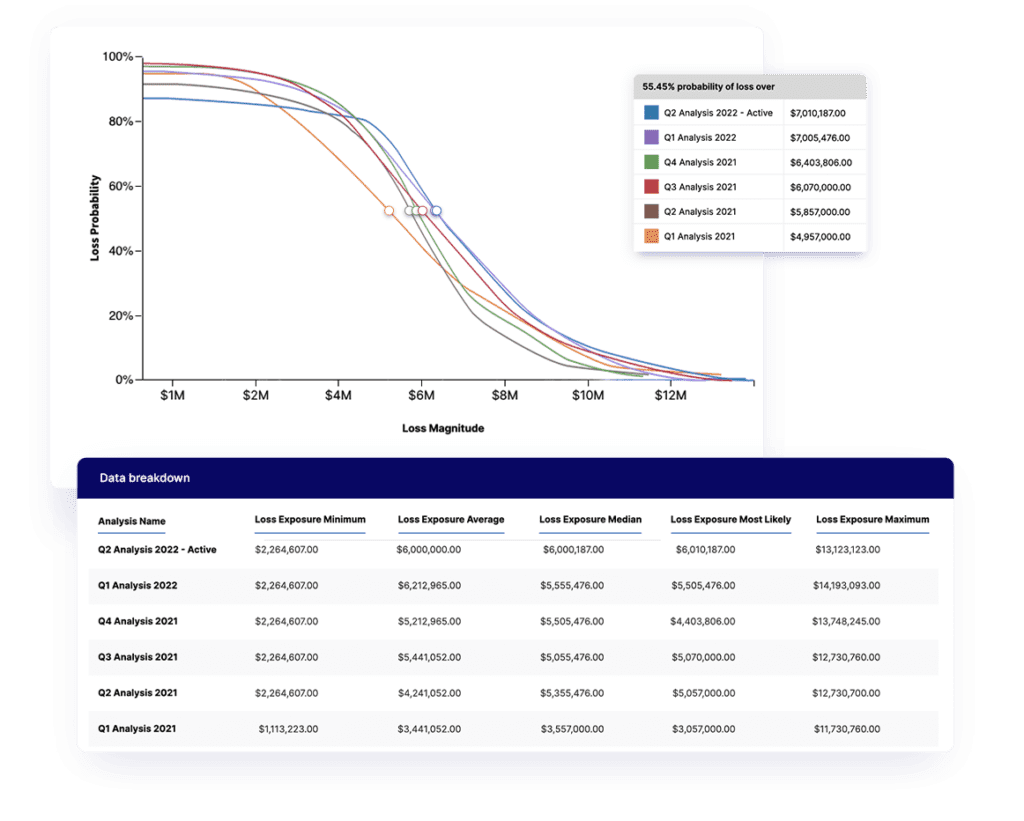

Loss exposure, loss magnitude, and loss event calculations are just a few of the risk quantification methods available to you in Risk Cloud Quantify. Run Monte Carlo simulations and simulate loss exceedance curves, and then compare analyses and aggregate outputs by business units, risks, and assets to determine your full risk exposure.

With Risk Cloud Quantify, you get access to unlimited calculations and simulations. Run and compare multiple different analyses to visualize how scenarios change over time as your controls, risk factors, and operating conditions evolve.

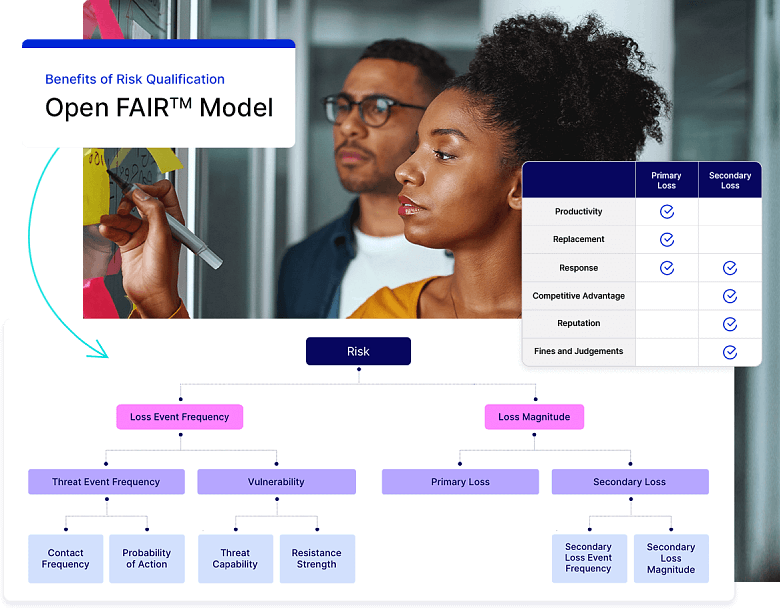

Risk Cloud Quantify generates Open FAIR quantified risk outputs to assess the financial impact of business risks. This industry standard leverages calculations like annual loss exposure and loss event frequency to turn business uncertainty into a competitive advantage. Trusted by cybersecurity leaders for over 10 years, Open FAIR is a proven methodology that can add clarity to any strategic business decision.

Risk Cloud Quantify can be used across business units, functions, and geographies to help you better allocate investments, identify acceptable risks, and uncover redundant or inefficient controls impacting your organization's ROI.

If you’re attempting quantitative risk assessment for the first time, it’s important to start small and work from a strong foundation. Working from your risk register, you can begin collecting data, scoping risks, and building different scenarios with a model like Open FAIR.

We recommend using existing qualitative assessments to prioritize data collection for your first quantitative assessment. Select an event with a high likelihood and magnitude, and look for supplementary data from existing sources like internal files (e.g., incident logs and reports), external data from published reports (e.g., Verizon Data Breach Investigation Report), or if you’re an existing Risk Cloud user, data from installed Applications.

Now you’re ready to conduct your first quantitative risk assessment. As you get started, it’s important to focus on incremental improvements instead of perfection. Directionally correct data pulled from public sources is still an improvement over reporting risks in reds, yellows, and greens.

The Open FAIR model is a trusted industry standard for risk quantification. It is a publicly available statistical model that generates a transparent, defensible output. Think of Open FAIR as a “glass box” instead of a “black box” – it is not proprietary and can be inspected and validated if necessary.

Risk Cloud Quantify uses the Open Fair methodology to help you determine annual loss exposure, loss event frequency, loss magnitude, and more.

Yes. Risk Cloud Quantify includes a Monte Carlo simulator that generates the dollar loss range output after running the simulation 50,000 times. Results are displayed in a sharable, annual loss exceedance curve (ALE) report.

While Open FAIR was primarily designed for IT and cyber risk management, it’s a trusted, open model that can be applied to any risk management use case. Assessment outputs are generated using Monte Carlo simulations, adding an additional level of familiarity and trust for non-cyber teams. Existing Risk Cloud users may purchase and implement Risk Cloud Quantify platform-wide to help translate risk into monetary terms across every use case.

Cyber attacks are up 38% in the last year, and they’re getting more costly. Do you know how…

In this webinar, LogicGate and Protiviti will explore the fundamentals of risk quantification and highlight how the practice…