Regulatory Compliance Management

Identify and address regulatory compliance gaps faster by linking obligations, assessments, and exams in one platform while automating workflows.

- Save time with automated regulatory monitoring and change management.

- Reduce regulatory risk through real-time compliance insights.

- Stay audit-ready by efficiently remediating issues across business units.

Outcomes at a Glance

80%

Reduction in Time to Complete Audits

+25%

Task Efficiencies Gained

98%

Decrease in Audit Findings

*Based on LogicGate customer case studies

Key Capabilities and Product Features

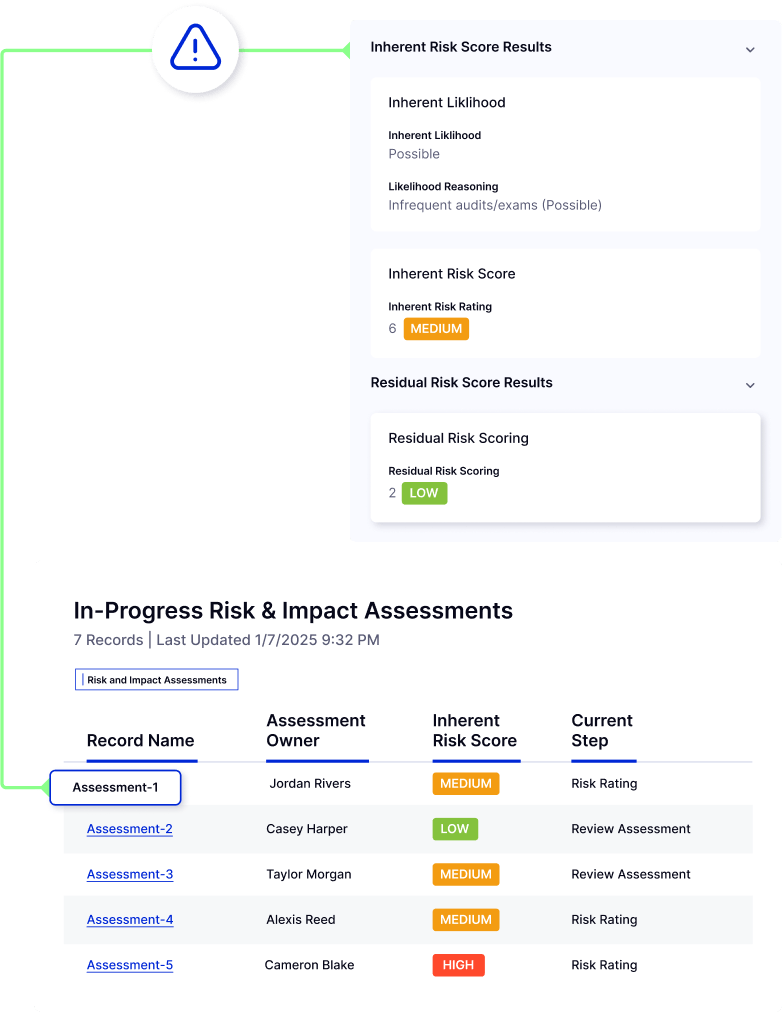

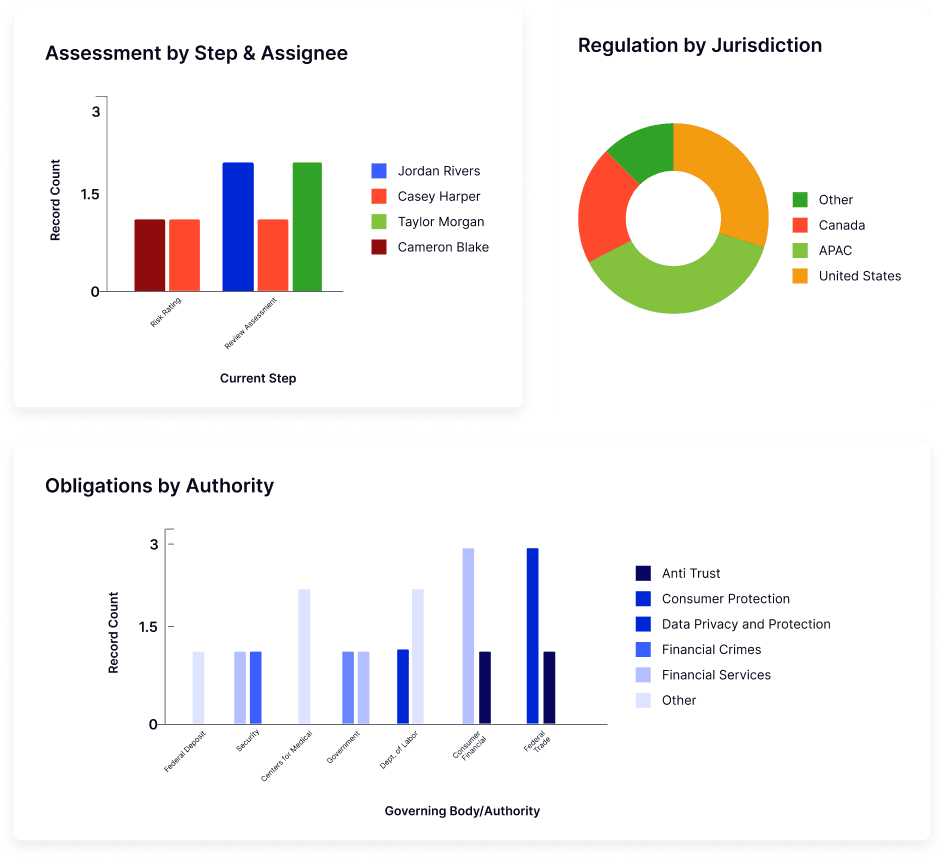

Reduce regulatory risk by linking tasks to controls, policies, and procedures while automating change management, assessments, and remediation workflows.

Ensure ongoing compliance through continuous auditing and monitoring while identifying potential risks related to non-compliance.

Engage internal stakeholders and drive accountability with a clear view of compliance gaps, remediation status, and deadlines.

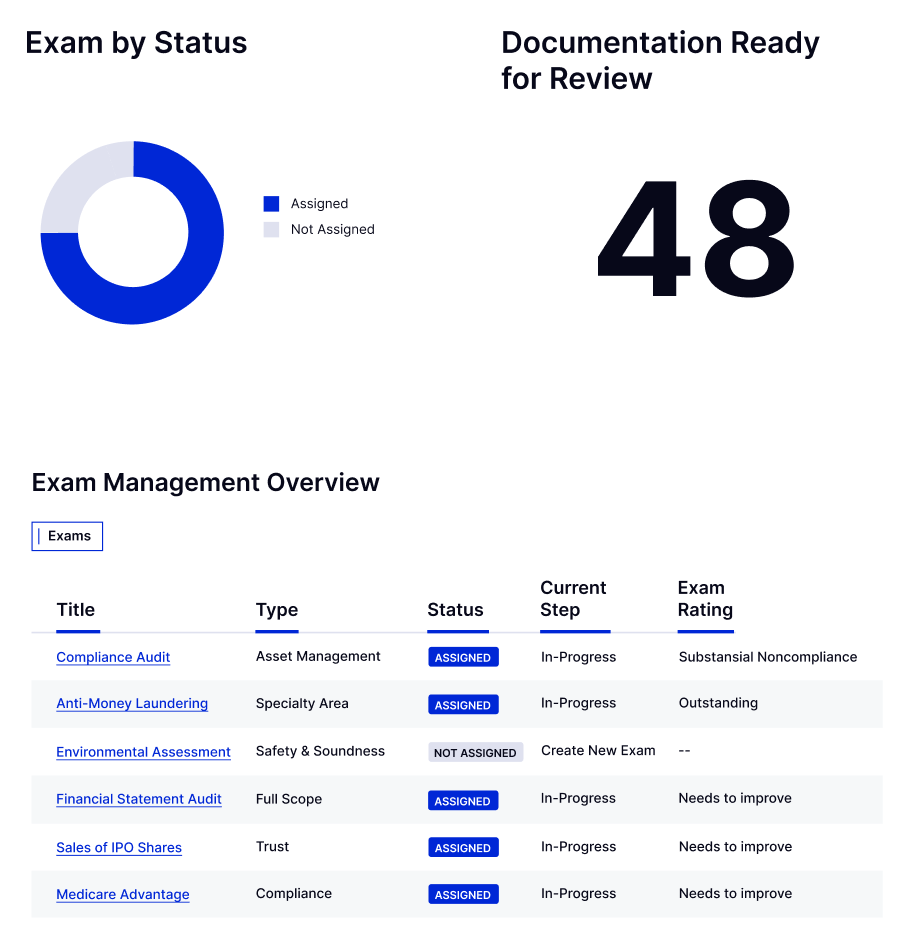

Centralize compliance documentation, streamline exam management, and easily track evidence version control.

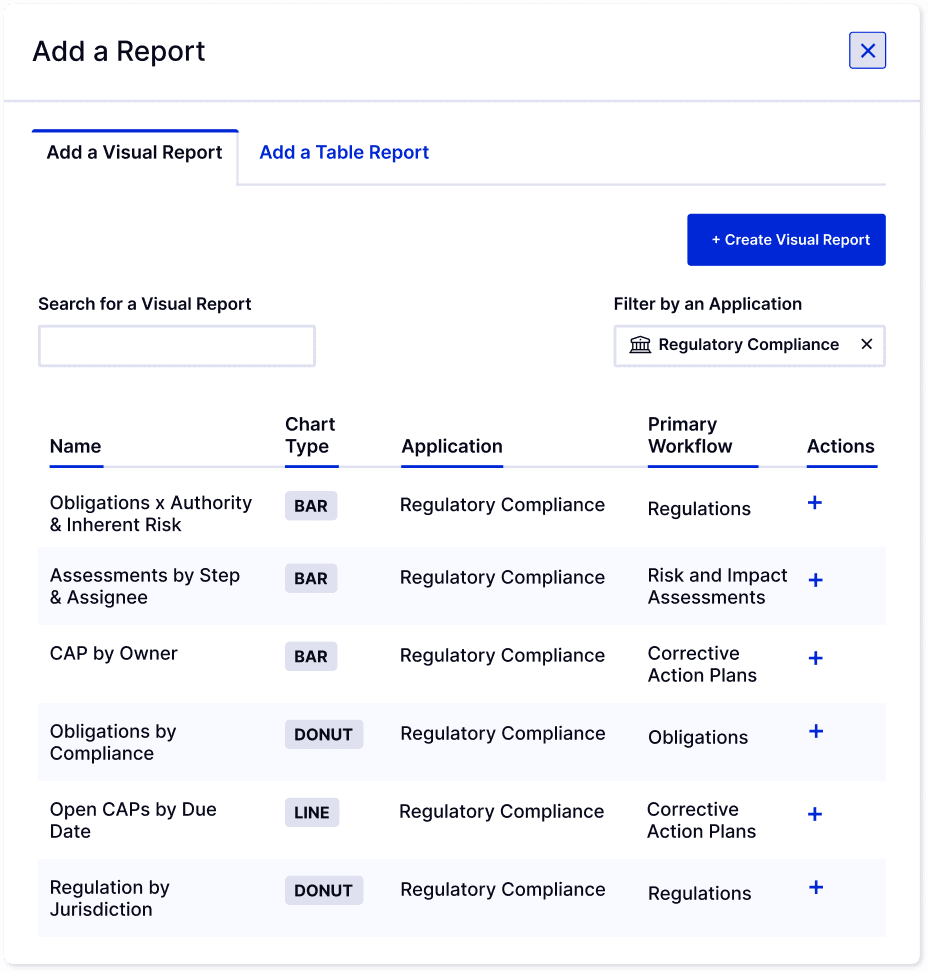

Track regulatory changes and generate reports to show compliance while validating program performance with role-based dashboards for informed decisions.

Regulatory Compliance Solution

From applications and integrations to frameworks and regulations, we partner with your compliance team to build a solution that evolves with your changing business needs.

Frequently Asked Questions

LogicGate’s Regulatory Compliance Solution streamlines compliance processes by automating tasks like evidence collection, assessments, audits, and reporting. It ensures that your organization meets regulatory requirements and reduces the risk of penalties and non‑compliance.

Regulatory Compliance Solution helps organizations identify regulatory requirements, track changes, and ensure adherence to various regulations, including ISO 27001, NIST CSF, SOC 2 and SOX. By centralizing compliance tasks, Risk Cloud® reduces the complexity of regulatory management and ensures that your organization stays compliant.

Yes! The Regulatory Compliance Solution works in tandem with other Applications and content inside Risk Cloud like GDPR, CCPA, and HIPAA, as well as integrated content providers like CUBE and Ascent.

Regulatory Exam Management involves preparing for and managing regulatory exams or audits. Risk Cloud helps businesses automate the documentation, reporting, and processes required to manage regulatory exams. By centralizing all necessary compliance data, LogicGate ensures that your organization is always prepared for regulatory exams, making audits smoother and less stressful.

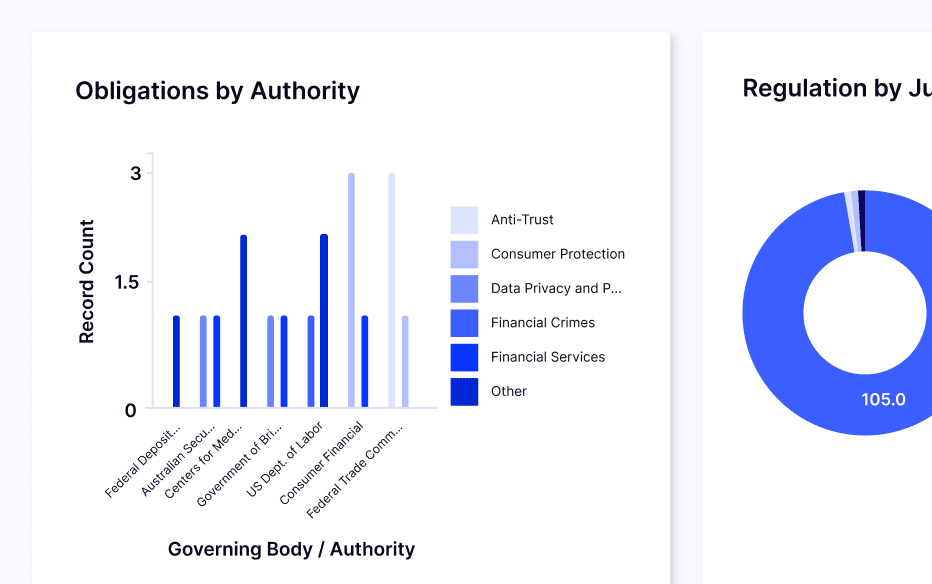

Through integration with CUBE or Ascent, this solution provides support for requirements from the following regulators:

• Consumer Financial Protection Bureau (CFPB)

• Commodity Futures Trading Commission (CFTC)

• Federal Deposit Insurance Corporation (FDIC)

• Federal Financial Institutions. Examination Council (FFIEC) IT Work Programs

• Financial Crimes Enforcement Network (FinCEN)

• Financial Industry Regulatory Authority (FINRA)

• Federal Reserve Board (FRB)

• National Futures Association (NFA)

• Office of the Comptroller of the Currency (OCC)

• Office of Foreign Assets Control (OFAC)

• Securities and Exchange Commission (SEC)

Risk Cloud’s Regulatory Compliance Solution helps financial institutions manage compliance with banking regulations, such as GLBA, NIST CSF, PCI DSS, CCPA, NYCRR 500, GDPR, and more. Risk Cloud automates the monitoring of regulatory changes, tracks compliance activities, and provides real-time reporting, ensuring that banks can easily meet regulatory requirements and avoid penalties.