U.S. financial institutions operate under the constant scrutiny of multiple regulatory bodies, including the Federal Reserve, FDIC, CFPB, and FINRA. Regulations such as AML (Anti-Money Laundering), BSA (Bank Secrecy Act), and KYC (Know Your Customer) demand that financial institutions maintain high standards of integrity, transparency, and risk management. Adding to these challenges is the increasing reliance on third-party vendors, particularly as Banking as a Service (BaaS) broadens the financial services landscape. Each new vendor relationship introduces potential cybersecurity risks, especially if oversight is lacking.

Challenges Facing Banking Compliance and Risk Management

- Keeping Up with Regulatory Compliance: Regulatory requirements become more complicated as operations, and assets under management, scale.

- Cybersecurity Threats: Banks remain top targets for sophisticated cyberattacks, putting financial and personal data at significant risk.

- Operational Inefficiencies: Disconnected systems and manual processes can lead to bottlenecks, missed deadlines, and human error.

- Third-Party Risk Management: With a growing dependence on external vendors, effective oversight is needed to manage third-party risk proactively.

The current environment demands a comprehensive approach to GRC that unifies risk management, compliance, and cybersecurity. That’s where LogicGate’s Risk Cloud comes in.

How Risk Cloud Solves Real Problems for Financial Institutions

LogicGate’s Risk Cloud has purpose-built Solutions for the financial sector. It brings all the elements of GRC into a single, flexible platform that allows teams to work smarter, faster, and with greater confidence.

- Gain Real-Time Insights with Centralized Risk Data: In most financial institutions, risk data lives in disconnected systems, which makes it tough to get a full view of compliance and risk exposure. Risk Cloud pulls this information together into one central platform, offering Chief Compliance Officers (CCOs) and risk teams an at-a-glance view of compliance across regulations like AML, BSA, and KYC. This real-time visibility allows teams to manage regulatory obligations proactively and reduce the risk of overlooked issues or last-minute scrambles.

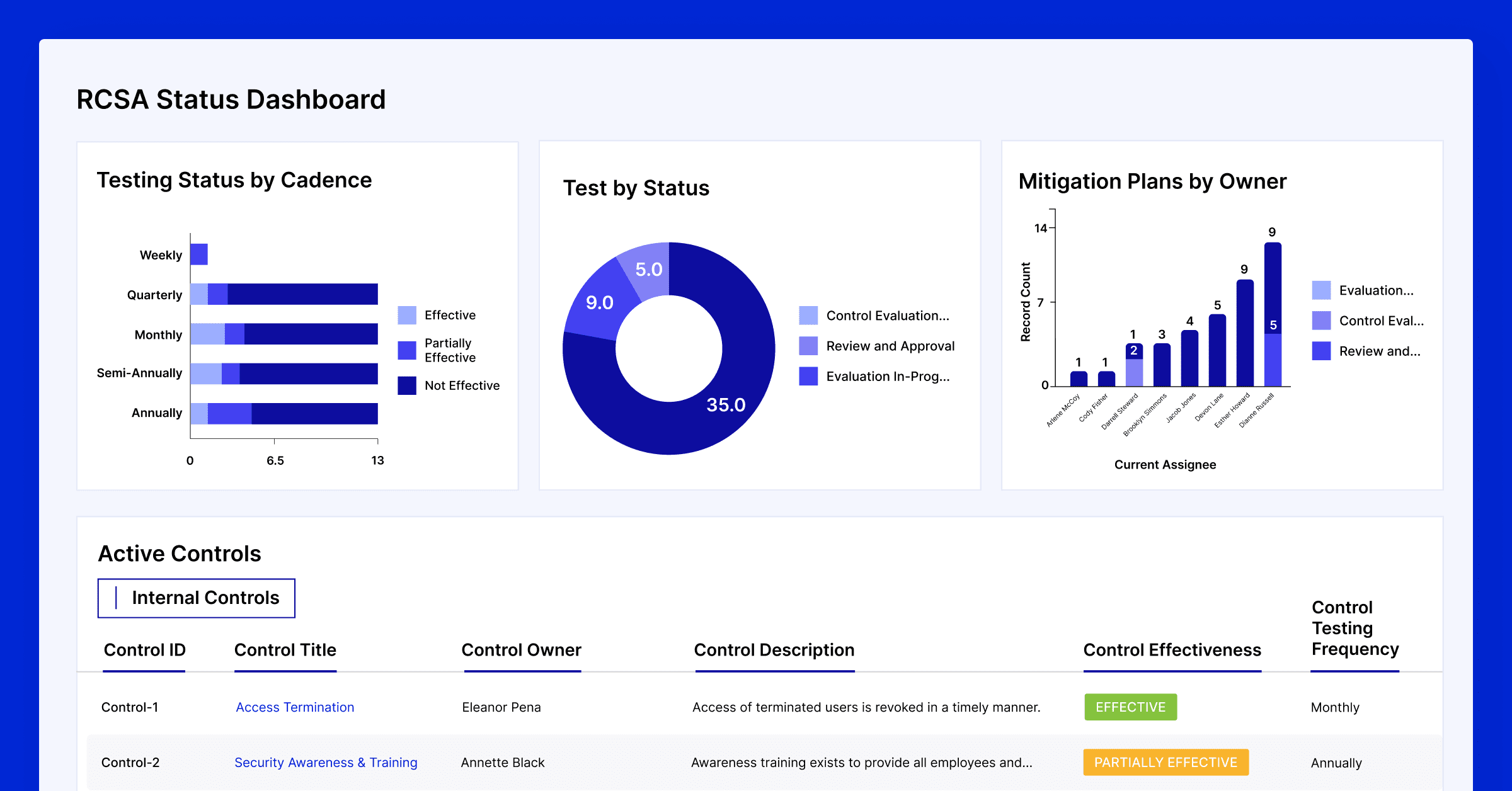

- Automate Risk and Control Self-Assessments: Manual processes drain resources and limit response times, especially in a fast-paced environment. Risk Cloud streamlines the entire risk assessment process by automating assessment scoping, evidence collection, and task assignments. For Chief Risk Officers (CROs) and CISOs, this means more efficient operations, less manual work, and quicker issue resolution – giving teams more time to focus on high-impact tasks.

- Manage Third-Party Risk with Confidence: Financial institutions are increasingly relying on third-party providers, many of which have their own varying security standards. Risk Cloud’s Third-Party Risk Management application enables financial institutions to keep a close eye on vendor security practices by offering ongoing risk assessment across the entire vendor ecosystem. By monitoring these relationships continuously, Risk Cloud helps institutions minimize third-party vulnerabilities to reduce both regulatory and reputational risk.

- Strengthen Cybersecurity and Response: Cyber threats to financial institutions are more sophisticated than ever, but LogicGate helps you stay one step ahead. Risk Cloud accelerates cybersecurity response by aggregating real-time cyber risk, vulnerability, and incident data then automating assessment and mitigation workflows. With these tools, organizations can safeguard customer data, protect their reputation, and minimize the risk of costly data breaches.

- Access Customizable Dashboards for On-Demand Reporting: Risk Cloud’s customizable dashboards make it easy for teams across compliance, risk, and cybersecurity to track key metrics at a glance. These role-based dashboards are tailored to the unique needs of financial institutions, providing real-time insights into Key Risk Indicators (KRIs) and Key Performance Indicators (KPIs). With this capability, teams can respond faster to risks, support strategic decision-making, and provide management and stakeholders with clear, data-driven reports on program performance.

Dynamic Growth with LogicGate

LogicGate’s Risk Cloud allows financial institutions to tackle today’s biggest challenges with confidence and agility. With everything from regulatory compliance to cybersecurity and vendor risk management in one dynamic platform, institutions can move away from fragmented processes and stay focused on what matters most: serving their customers securely and effectively.

Why LogicGate?

- Connect All Three Lines of Defense: Out-of-the-box workflows connect stakeholders across the first, second, and third lines of defense and provide clarity and transparency within the regulatory, risk, controls, policy, and issues data they need, when they need it.

- Accelerate Time-To-Value: Pre-built assessments built for banking, including KYC, AML, CFPB, FFIEC, OSFI, and Complaints Investigation.

- Centralize and Cross-Map Regulatory Requirements: Natively supported controls content aligned to industry standards like FFIEC CAT, PCI DSS, GLBA, NIST CSF, 23 NYCRR 500, GDPR, CCPA, and more.

- Align to Banking Industry Standards: Recommended risk and control libraries created specifically for banking organizations by LogicGate’s GRC Content and Strategy team.

- Create A Clear Path Toward Program Maturity: Solution Success Kits based on program maturity that meet your teams where they are today and enable you to mature over time without costly change orders.

LogicGate’s Risk Cloud empowers financial institutions to navigate regulatory complexities, bolster their cybersecurity defenses, and streamline operations- all from a unified platform.

Ready to learn more? Book a demo today and see how LogicGate’s Risk Cloud platform is transforming Risk and Compliance for financial institutions.