Regulatory Exam Management Application

Meet regulatory obligations and effectively prepare for upcoming exams with connected data repositories, automated workflows, and real-time program insights.

What is the Regulatory Exam Management Application?

The Application streamlines regulatory exam management by centralizing documentation, automating evidence requests, and simplifying collaboration. The Application makes it easier to track compliance and address gaps across diverse requirements and exam scoping. by improving visibility and accountability throughout the examination process.

Streamline Regulatory Exam Management by Centralizing Requirements, Automating Preparation, and Accelerating Remediation

Create a scalable program that adapts to various exam processes, teams, and regulatory authorities, ensuring efficient compliance with regulatory requirements.

Proactively Prepare for Regulatory Exam Requirements from Authorities Like FINRA, SEC, NCUA, OOC, and More

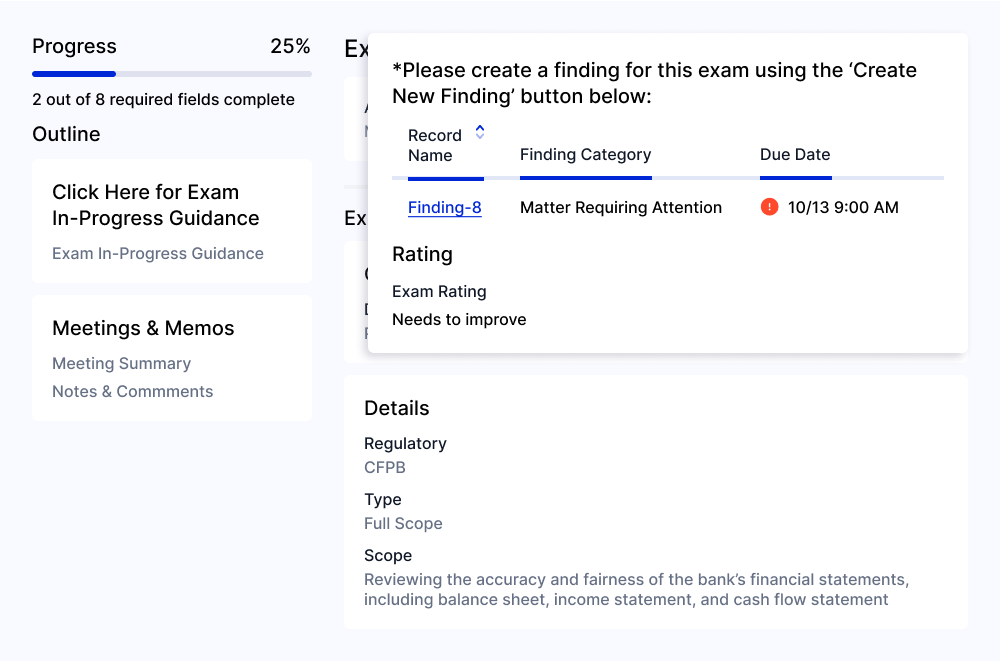

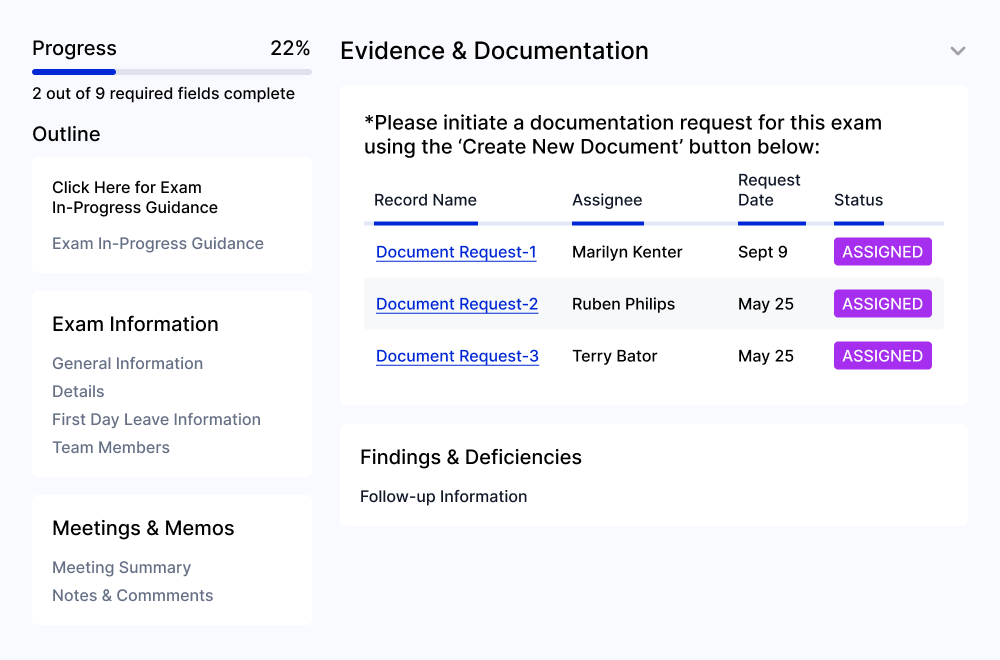

Establish a single source of truth to efficiently manage evolving regulatory requirements, minimizing redundant work. Document the exam scope, request and store necessary files, and streamline remediation of findings. Integrate easily with everyday tools like Google Drive, Microsoft 365, and the Risk Cloud® Policy and Procedure Management Application to enhance collaboration.

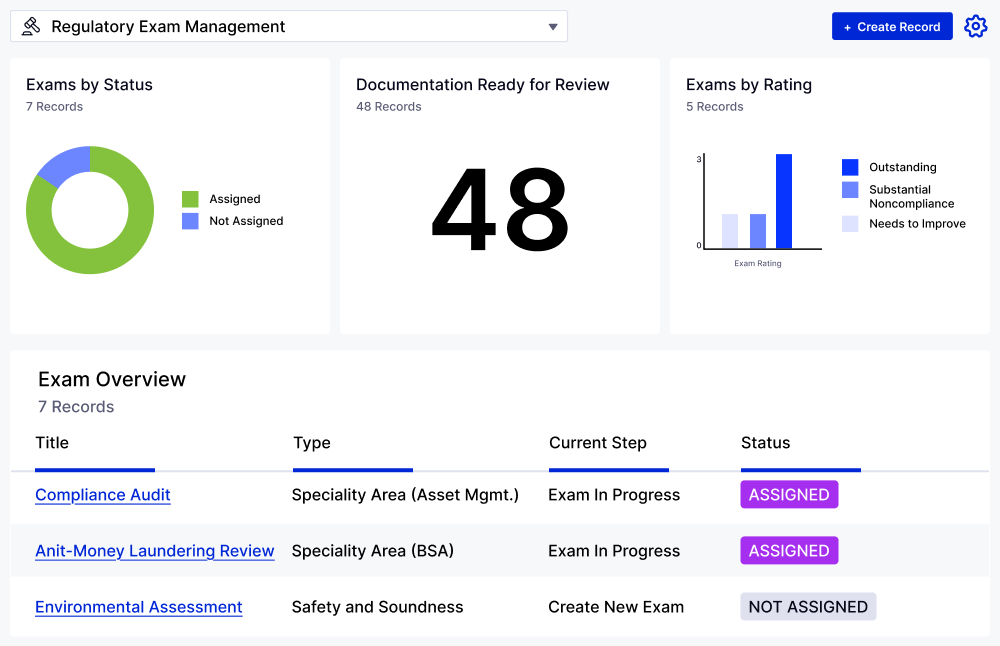

Pass Your Next Exam with Time-Saving Efficiencies and Actionable Exam-Readiness Insights

Quickly gauge exam readiness with real-time reports of in-progress exams and document requests. Accelerate progress and keep teams on track with automatic assignments, notifications, and deadline reminders. Improve external collaboration and ensure regulators have access to the most up-to-date information by sharing evidence via secure public forms.

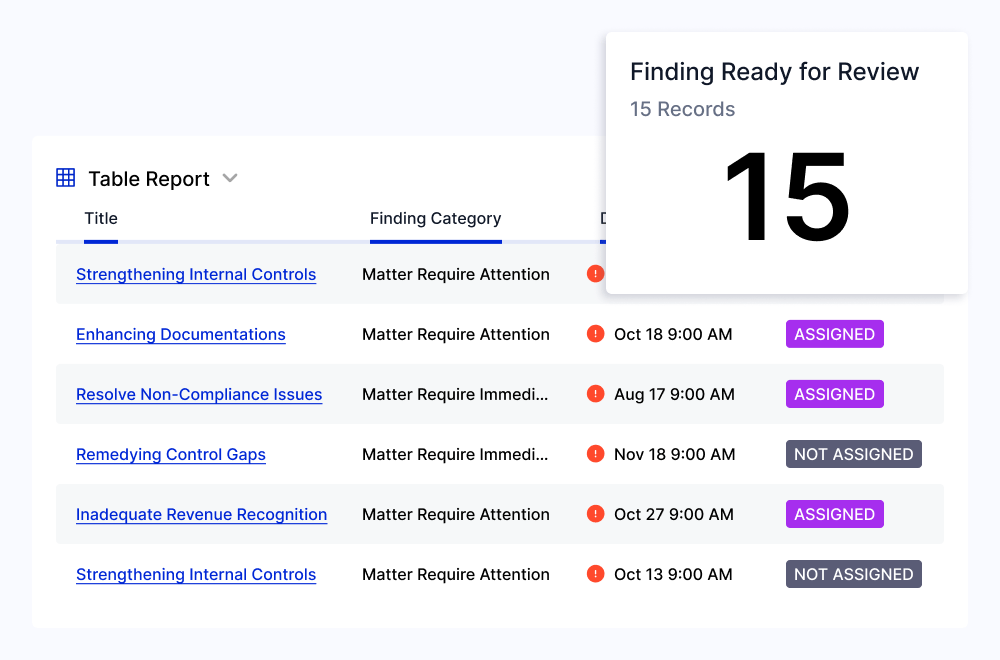

Quickly Mitigate Exam Findings to Avoid Financial and Reputational Damages

Accelerate remediation of Matters Requiring Attention (MRA) and Matters Requiring Immediate Attention (MRIA) by connecting task owners with the information they need at the right time with pre-built workflows and role-based dashboards. Easily track open tasks by the due date, the average time to remediation, the percent of closed findings, and more in real time.