Proactively Manage Cyber, Vendor, and Data Risks to Safeguard Your Bank’s Future

Financial institutions face growing cyber threats, third-party vulnerabilities, and regulatory pressures. Strengthen your risk posture with an integrated, proactive approach.

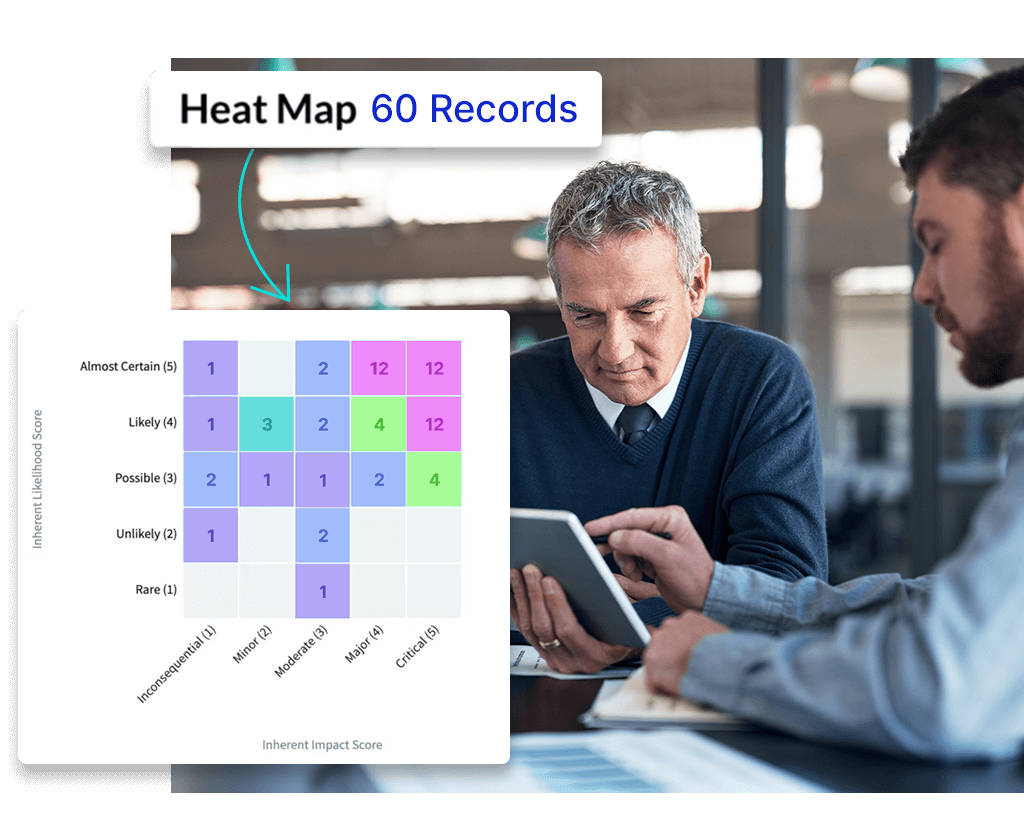

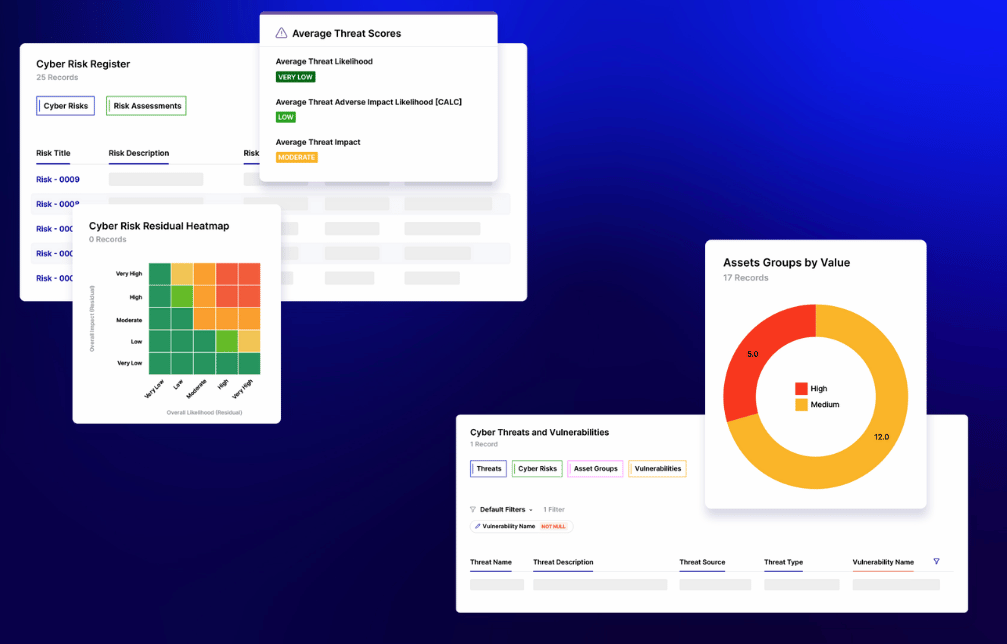

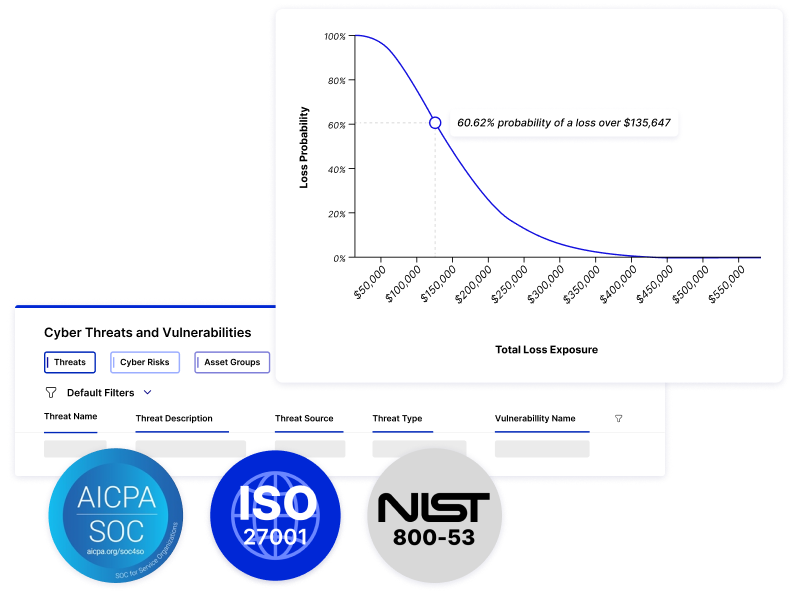

Cyber Risk Management

Identify, assess, and mitigate cyber threats before they disrupt operations. Strengthen resilience with real-time threat monitoring, risk assessments, and security controls.

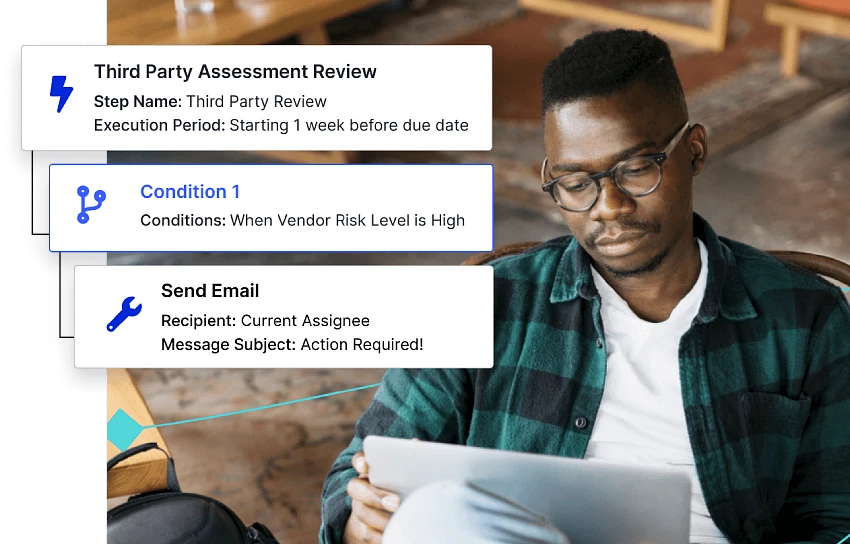

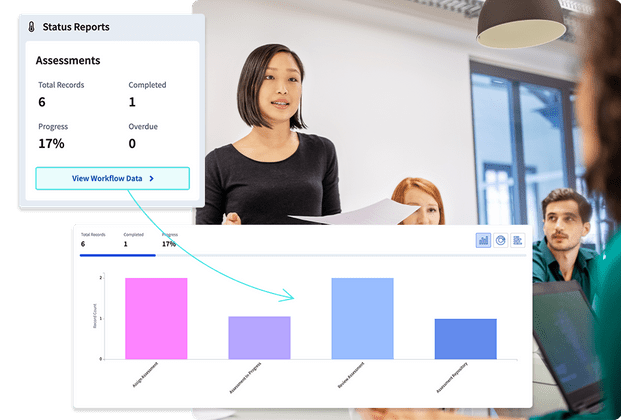

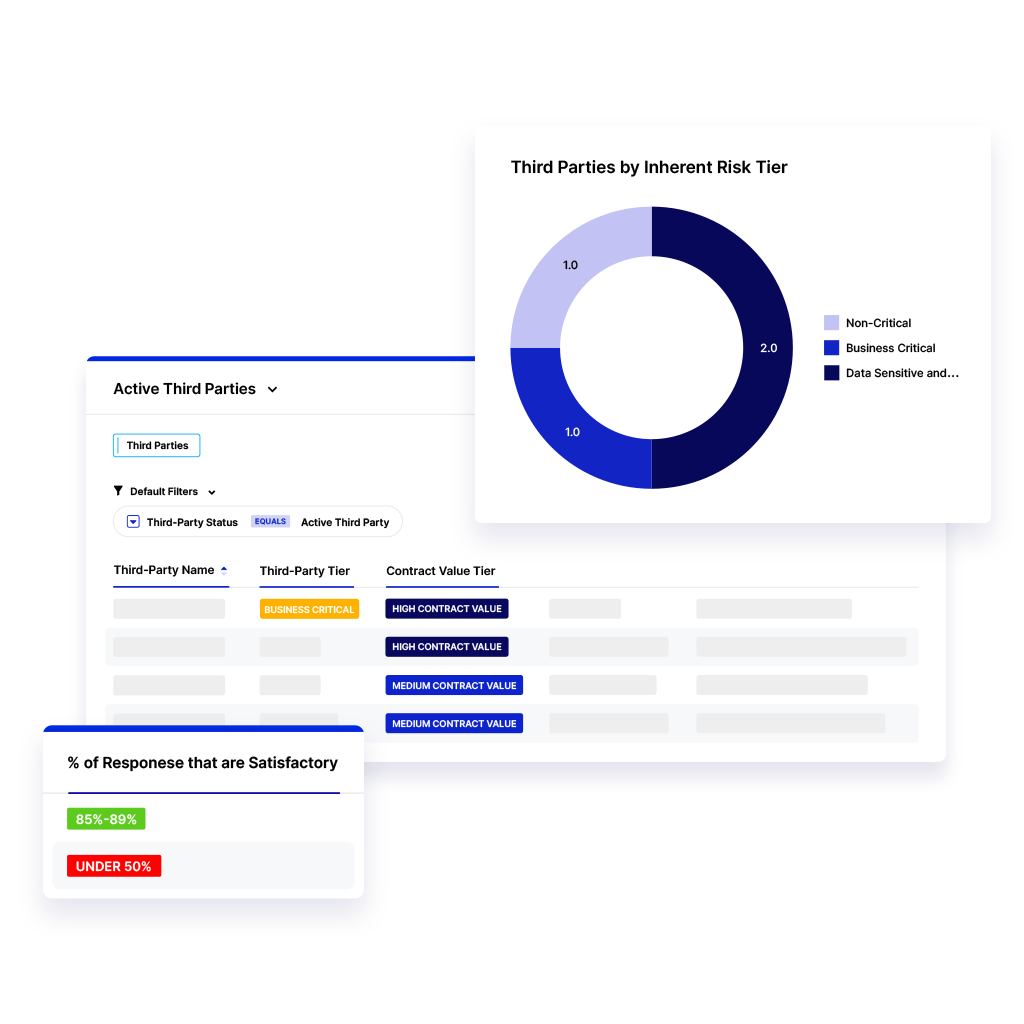

Third-Party Risk Management

Ensure vendor security and compliance by continuously assessing third-party risks, reducing exposure to supply chain disruptions and regulatory violations.

Data Privacy

Safeguard customer and institutional data, ensure regulatory compliance, and minimize breach risks with automated controls and proactive monitoring.

Explore the Right Solutions at Your Own Pace

Take 90 seconds to discover how each solution can help you manage risk, improve efficiency, and stay compliant. Choose what matters most to your bank and dive in when you're ready.

Cyber Risk Management

Third-Party Risk Management

Data Privacy

LogicGate wins "Best Risk Management Platform" designation in 2025 FinTech Breakthrough Awards Program.

Proactively Reduce Cyber, Third-Party, and Data Risks Before They Become Problems

Strengthen your security posture with a proactive approach to cyber risk, vendor oversight, and data protection—without adding complexity.

Cyber threats, vendor vulnerabilities, and data exposure are constant challenges, but their impact can be minimized. A proactive strategy helps your bank identify security gaps, automate risk assessments, and enforce stronger controls before issues escalate. With LogicGate, you can centralize cyber risk management, continuously monitor vendor security, and ensure data privacy compliance.

Strengthen Your Risk Strategy TodayUnaddressed Cyber and Third-Party Risks Can Lead to Costly Consequences

Without proactive risk management, gaps in cybersecurity, vendor security, and data protection can lead to costly breaches and compliance failures.

Waiting until a security incident happens isn’t a strategy—it’s a risk. Banks face increasing regulatory scrutiny, third-party vulnerabilities, and data security threats that can escalate without warning. Without a proactive approach, your team will always be reacting to crises instead of preventing them. LogicGate helps financial institutions identify risks early, automate assessments, and enforce stronger security measures to keep data, vendors, and infrastructure protected.

Take Action Before Risks Become Incidents