Enterprise Risk Management

Quickly assess and take action on your organization’s biggest risks with a connected view of risks and controls.

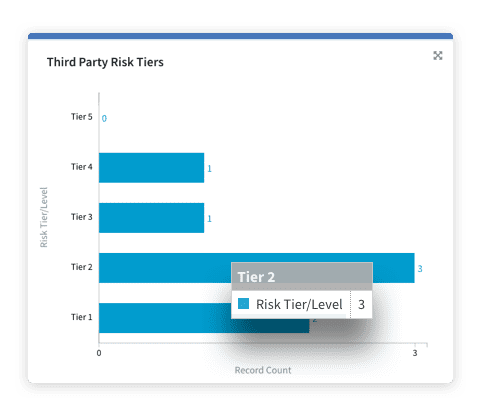

Sometimes the sheer number of risks your financial institution faces makes it hard to know where to dive in. With Risk Cloud, you can harness the power of an enterprise-grade platform to prioritize and take on any risks that come your way.

See For Yourself

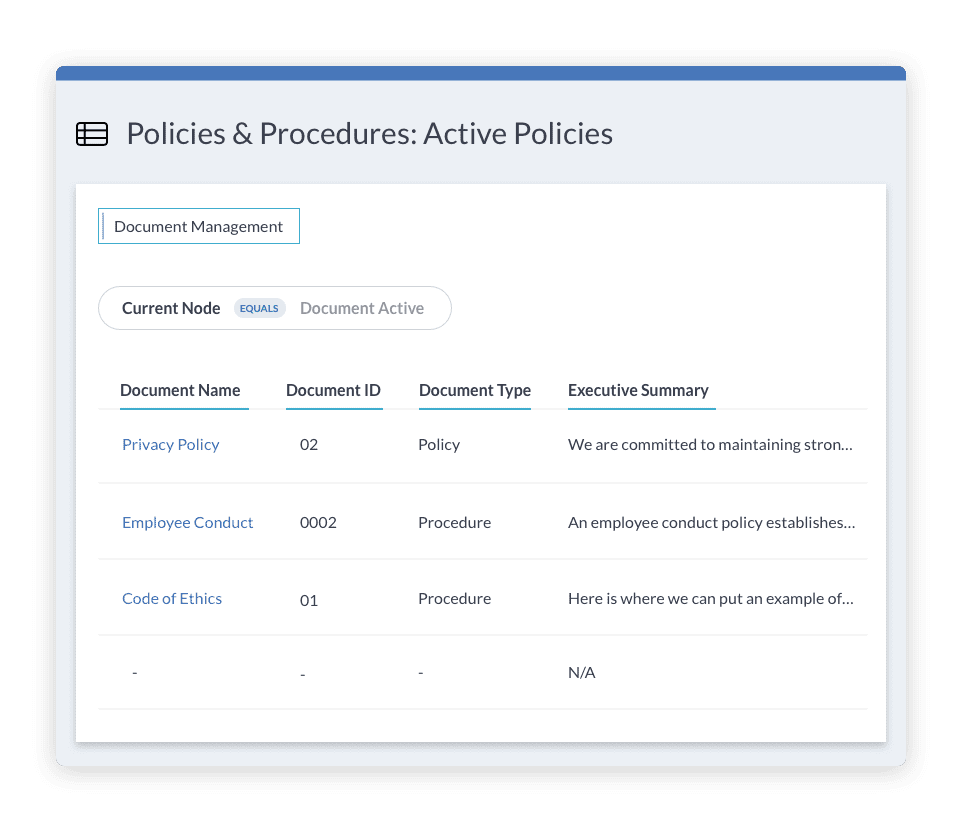

Are you shuffling through tabs and spreadsheets trying to organize internal and external documentation? Not on our watch. Store all risk related documents in one place for easy access, automated delivery, and efficient audits.

See the Difference with Risk CloudYou don’t want to get on the bad side of the Federal Reserve. Or OCC. Or SEC, CFPB, CFTC, or FINRA. But when you try to manage all the regulations and compliance requirements put out by each of these organizations, that’s a lot to keep up with. Risk Cloud can help.

View Compliance Management Brochure

- Risk Partner, Financial Services Industry

Quickly assess and take action on your organization’s biggest risks with a connected view of risks and controls.

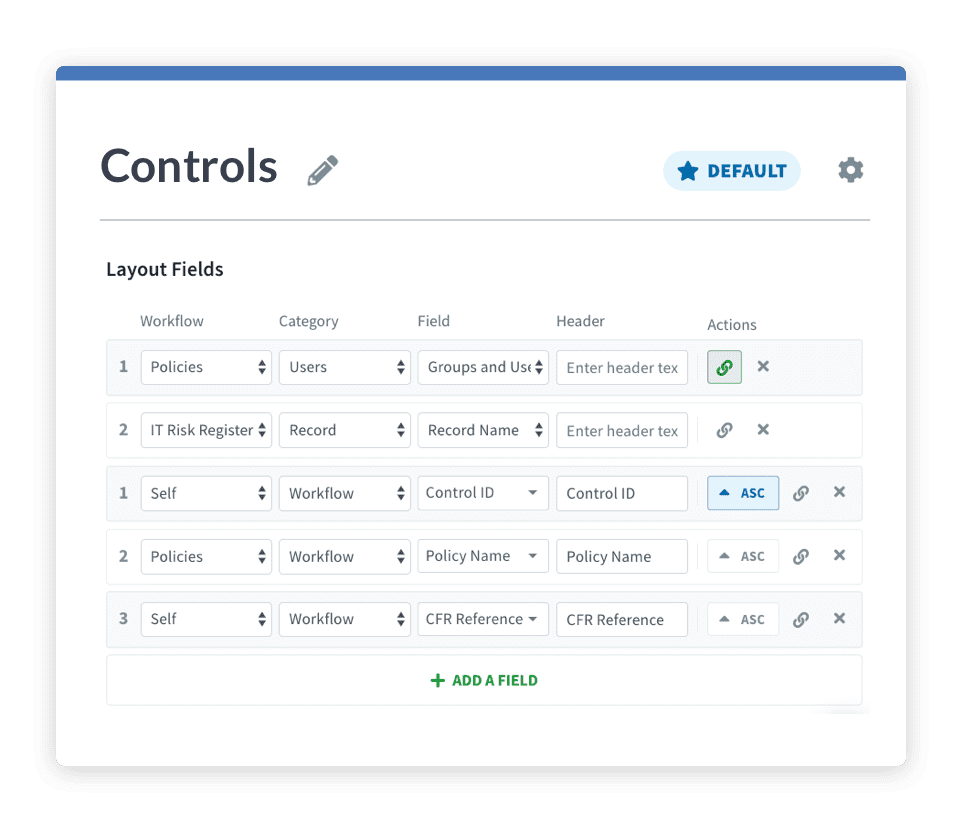

Dynamically link your overlapping regulations, obligations, and controls to identify gaps and reduce redundant tasks.

No more flipping through multiple tabs and systems. Find everything you need in one place to resolve issues.

If you want your GRC engine to run smoothly, you need to look at systems holistically. Create a…

As BankProv's business has grown, the company needed a proactive compliance management solution with more flexibility, active monitoring,…

In March we hosted our annual Agility User Conference in Chicago gathering hundreds of Compliance, Cybersecurity and Risk…

As a GRC software company founded by practitioners for practitioners, we understand your GRC program needs more than…

To be the best company, we need the best people. The employees of LogicGate are our most valuable…